Canada has a pot problem, as Quartz Media recently warned us, but it’s a lucrative problem to have. One thing holding back this $8-billion market (Forbes Magazine, April 13, 2017) is supply, and one little-known company plans to be the steward of it in a big way.

When Canada legalizes recreational marijuana in less than a year, in line with a bill pushed through by Prime Minister Justin Trudeau, legal supply is likely to be limited. There may not even be enough even if we are only considering medical marijuana usage.

The supply picture is so fantastically tight that Health Canada has had to streamline the approval process for growers because medical marijuana users have tripled in number since last year alone, according to Quartz. When it becomes legal recreationally, a Deloitte report estimates the economic impact will be worth $22.6 billion annually—in other words, more than the combined sales of beer, wine and spirits.

Meet Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF), the world’s first cannabis streaming company, backed by a powerhouse team, with the biggest industry trailblazer leading the way.

Not only is Cannabis Wheaton jumping into a huge potential market where supply is forecast to struggle to reach demand, but it’s offering a lifeline to new and existing growers who need financing to get off the ground fast.

Producers need a miracle grow strategy, and Cannabis Wheaton is stepping in to fill the gap with a “royalty” business model that is new to this market.

And for investors, the major upside is that this model removes the risks associated with putting all your money into a single-crop producer.

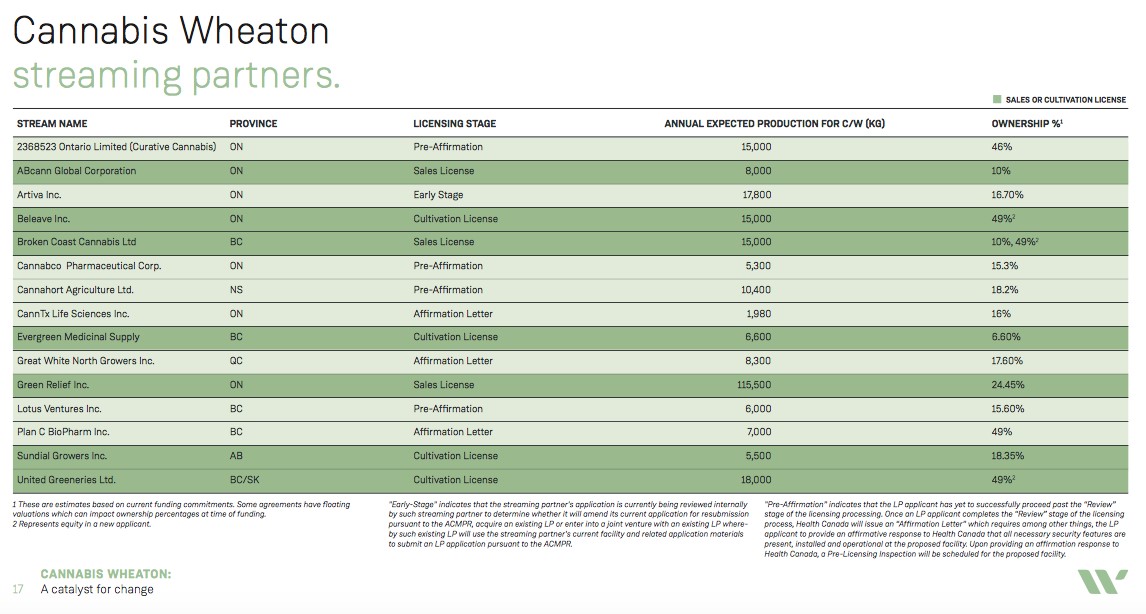

Cannabis Wheaton is intending to ‘stream’ pot, and 15 partners have already been lined up, along with 1.4 million square feet of growing acreage.

Here are 5 reasons to keep a close eye on Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) right now:

#1 ‘Streaming’ Deals Already Lined Up

To say that Cannabis Wheaton is a catalyst for change in an $8 billion market that is set for an explosive boost in less than year is an understatement.

The company’s royalty business model reduces risk for everyone. For the investor, it means less risk associated than with a single-crop producer. For producers, it means more opportunities and avenues of financing to get growth off the ground.

This is the evolution of the traditional licensed cannabis producer—and Cannabis Wheaton is the only company on this track.

And they’ve already sealed 15 partnership agreements in 17 facilities across six Canadian provinces to fund the construction and expansion of cannabis growing facilities and innovations. In return, they get minority equity interests and a portion of the cannabis produced. They’ve also got 39 solid clinic relationships, and this is growing fast, with access to over 30,000 registered medical marijuana patients.

(Click to enlarge)

By 2019, just for starters, Cannabis Wheaton will have more than 1.4 million effective square feet of pot cultivation.

But it’s not just about risk, for investors—it’s about exposure. Through Cannabis Wheaton, exposure isn’t limited to a single-crop: You get access to multiple licensed producers to take full advantage of this $8-billion industry.

#2 Quick Scaling and Capitalization of Market Share Potential

A unique confluence of factors, including the fact that cannabis remains federally illegal in the United States, means that Canadian companies are in our opinion positioned to become the “multi-nationals” of cannabis – an area that as we know will rival alcohol and tobacco due to the sheer size of demand and revenues.

Within this set of Canadian cannabis producers, an even smaller subset – probably half a dozen or so companies have the capital and ongoing ability to raise funding that make them the most likely to capitalize with first-mover advantage on not just Canada’s 36 million person population, but a potential population of 500 million people or more in jurisdictions like Germany and Brazil that are also opening up to cannabis and that look to Canada’s framework and quality standards as they develop their internal regimes for production and distribution of cannabis products.

If one looks at this as a funnel:

Canada is in a special situation to potentially create the multinationals for cannabis.

Only a handful of companies in Canada are well-funded enough to scale into this.

Of these, Cannabis Wheaton, due to its streaming structure is well positioned due to the fact the company can scale quickly and diversify risk as more than a dozen different teams – its partners – build out facilities concurrently.

The combination of circumstances that have come about to give a handful of Canadian companies and possibly, specifically Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) a first-mover advantage in becoming the multinationals of cannabis.

Because Cannabis Wheaton is the only company employing the streaming model, it has far and away the best opportunity to meet scaled up capacity and deliver on this huge global market opportunity.

Cannabis Wheaton’s model is intended to maximize profits by minimizing operational expenditures.

(Click to enlarge)

Bottom line: What Netflix is to movies and TV series, Cannabis Wheaton could be to pot. Or, what Silver Wheaton (NYSE:SLW) is to the mining industry. That company strikes a deal with a miner to purchase part of its future metal production in exchange for upfront cash. Investors love it because it gives them lower-risk and diversified exposure to the mining industry.

But this could even be better because Cannabis Wheaton finances the facility and then takes a ‘stream’ of product that comes out of the facility, but it doesn’t touch the product itself; it takes the royalty or it directs the producer to ship the product to Cannabis Wheaton’s customer.

#3 Management Play Backed by Political Heavyweights

Not only is this an idea that has the potential to take an $8-billion industry into the next phase, with brilliant timing—but it’s also being led by an experienced management team with extraordinary vision, and a track record to go along with it.

CEO Chuck Rifici is a household name in Canada’s marijuana industry. He co-founded the largest full-scale producer of government-sanctioned marijuana—Canopy Growth Corp. – and then took it public in April 2014 as its CEO. It’s still the largest public cannabis company around, and today’s it boasts a $1 billion market cap. And it’s the benchmark for success in the industry.

Not only has he led the industry’s most successful cannabis company to stardom, but he’s also sat on the board of other industry darlings, including Supreme Pharmaceuticals (SPRWF), Aurora Cannabis (ACBFF) and CannaRoyalty (CNNRF).

And it’s not just about management: Cannabis Wheaton is backed by political heavyweights, as Canadian politicians swarm onto the marijuana scene to cash in on the anticipated profits.

Rifici himself is former chief financial officer of the federal Liberal party. And the company’s strategic advisor is Rick Dykstra, former Conservative Member of Parliament and current party president in Ontario.

In June, the company added another heavy weight as president and director—industry-leading expert Hugo Alves. As a partner at Bennett Jones LLP, Alves founded and built the law firm’s Cannabis Group—the leading cannabis-focused legal advisory business in the country. He’s another highly-respected marijuana industry pioneer, who knows everything there is to know about cannabis licensing.

When it comes to regulatory affairs, Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) has it covered—and beyond—with Alves’ experience and expertise. And this knowledge could benefit all of Cannabis Wheaton’s streaming partners.

Alves was the first big firm lawyer in Canada to take what he calls a ‘big firm’ approach to pot. He ended up acting for 12 of the leading license producers and some 60 license producer applicants, not to mention another 50 ancillary businesses in the cannabis space. He’s got high-level contacts at every vertical in this industry.

#4 Exploiting a Huge Industry Gap with Looming Supply Shortages

Canada has over 150,000 medical marijuana patients, and that number is expected to grow to 500,000 by 2021, according to Canaccord Genuity. Yet, existing patients already bemoan supply shortages. To meet projected demand by 2021 just for medicinal purposes, Canada will need 150,000 kilograms of pot—with a sale value of $1.8 billion.

When this goes recreational, supply will be in real trouble. Canaccord Genuity estimates that by 2021 there will be an additional 3.8 million recreational users consuming 420,000 kilograms of pot (that’s worth around $6 billion).

To put this into perspective, Canada only has 40 licensed producers right now and last year, they grew only 31,000 kilograms—in other words, 5 percent of anticipated demand, according to the Financial Post.

But shortages are where things get lucrative, and the Canadian government is also keen to make sure supply meets demand. That’s why they moved to make the licensing process a lot easier in May last year.

For Cannabis Wheaton, it’s all about helping the streaming partners being the most dominant partners they can be, as Alves says.

The gap Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) is exploiting is a huge one: “There is a segment of the marketplace where people are trying to get their facilities built and they don’t have access to capital at all,” Alves told us.

Finding money to build facilities when you have no assets is tricky. That’s where the evolutionary genius of Cannabis Wheaton comes in, financing the producer at an aspirational valuation but letting the producer keep control, while Cannabis Wheaton takes an allocation of their production yield.

#5 First-Mover, and Only-Mover Advantage

Cannabis Wheaton has ‘only-move advantage’ because it’s the pioneering force behind the “financing by streaming” of the Canadian pot industry.

It’s the first company to bring the streaming business model to this market, and its business model makes it easier for investors to get in on this burgeoning market with lower-risk exposure to diversified licensed producers.

With producers under pressure to increase production by 10 times in order to keep pace with legalization for recreational use, Cannabis Wheaton has seen the gap in capital and is taking swift advantage of that. It has already signed deals with 15 partners, and counting. It’s a win-win for everyone: The producers get to keep control of their production, they get to leverage Cannabis Wheaton’s broad capital, regulatory, licensing and cultivation expertise, and Cannabis Wheaton and its investors get a nice stream of product or proceeds royalties.

We’re always looking for pioneers in new market spaces, and when it’s an estimated $8-billion market with a dearth of supply and a voracious demand, the company that has the best chance of fundamentally changing this space usually wins. We’ve found this in Cannabis Wheaton, and the fact that it’s led by industry leaders and backed by political heavyweights from all spectrums doesn’t hurt at all.

Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) is one most nimble participants and the company is set up uniquely to scale fastest into a market that, if it goes global, is poised to be dominated by Canadian companies with first-mover advantage and an eye on establishing footholds internationally.

Honorable Mentions:

Insys Therapeutics (NASDAQ:INSY) is generally known as a “marijuana stock” but it would be a bit of a misnomer to lump this company in with pot stocks. Insys’ main product is a sublingual pain medication known as Subsys. However, using the same proprietary sublingual spray technology and their advanced knowledge of synthetic cannabinoids, the company is at the forefront of a new pharmaceutical movement.

Founded in 1990, Insys has been around the block. The company clearly has staying power and investors have taken note. With a market cap of nearly $700M, Insys is a promising investment for those interested in dipping their toes into the marijuana realm.

A company which many are familiar with, Scotts Miracle-Gro Co (NYSE:SMG) is taking full advantage of the marijuana boom. This North American company’s products include Miracle-Gro, Roundup, Liquafeed and other solutions for growers interested in keeping their plants healthy and bug-free. Because it is a household name, the company stands to benefit from the coming “green rush.”

In the past several months, Scotts Miracle-Gro has seen a notable gain in its stock price, likely attributed to the recent string of cannabis stories. Canada’s upcoming legalization vote could very well spark further interest in the company, and send the stock further up in the food chain.

Zynerba Pharmaceuticals (NASDAQ:ZYNE) is a company that is diving deep into cannabinoid therapies. Currently, the company has only two drugs in development; ZYN001 and ZYN002. ZYN001, a THC pro-drug patch, aims to treat a number of conditions through a revolutionary transdermal delivery system while ZYN002, another transdermal delivery system, this time through a gel, is the first and only synthetic non-psychoactive CBD drug of its kind. And Zynerba has the patents on both products.

Zynerba Pharmaceuticals is another company which has seen modest growth as the marijuana push gains speed. The company, which is at the forefront of new treatments focusing on THC, is set to make out like a bandit upon legalization. Not only will the act open more doors for the company, it will also bring well-deserved notoriety.

Source Article from http://feedproxy.google.com/~r/blacklistednews/hKxa/~3/NVb4-jO92Lc/M.html

RSS Feed

RSS Feed

September 18th, 2017

September 18th, 2017  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: