Dow Jones Industrial Average

The Dow Jones Industrial Average is currently trending bearish after yet another series of dramatic developments in the White House. By Friday, 18 August 2017, the knives were out for White House chief strategist Steve Bannon. The former film producer and media tycoon from Norfolk Virginia is a Harvard Business School graduate with strong right-wing leanings. White House press secretary, Sarah Huckabee Sanders had this to say about Bannon’s departure, ‘We are grateful for his service and wish him the best.’

Bannon has been labelled everything from a white supremacist to an anti-Semite and the unofficial leader of the alt-right. After the disastrous Charlottesville tragedy, Trump was slow to criticize white supremacists, and this led to an upsurge in public disdain for anyone espousing those views. Bannon fit the bill perfectly. Bowing to media pressure, the White House acted decisively and fired Bannon from his role as chief strategist.

As you can see from the latest graphic above, the Dow Jones Industrial Average does not respond positively to political rancour. It is currently trading at 21,674.51, up 9.67% for the year to date. The 1-year return on the Dow Jones is 19.70%. As for the S&P 500 index, it too has plunged spectacularly from 16 August when it was trading at 2468.11 to its current level of 2425.55. For the year to date it is up 8.34%. The 1-year return on the S&P 500 index is 13.37%. As for the NASDAQ composite index, it has a year to date return of 15.48% and a 1-year return of 20.15%. On August 16, the NASDAQ dropped from 6,345.11 to 6,216.53 (August 18, 2017).

While markets may appear to have moved south after Bannon’s departure, they in fact rallied as traders, speculators and investors cheered his exit from the White House. It is now believed that the strongest conservative influence on the president is gone and he will likely move further to the left. According to a New York Times op-ed, Trump was growing increasingly weary of Bannon, since he thought he was responsible for leaking sensitive information to the media. Bannon is a firebrand, and his words are as caustic as his ideology. He threatened to ‘go to war’ with anyone who stands in his way. These comments will likely affect markets to a degree, and already we have seen gold hitting $1,300 per ounce as traders adopt a risk-off approach to equities. Similar trends are evident in the price of silver – another safe-haven asset.

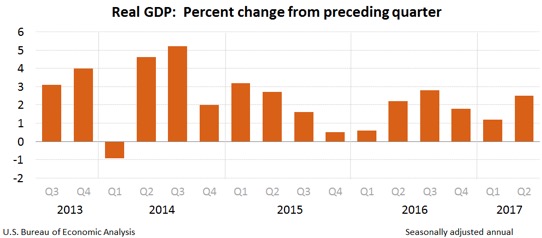

As far as traders are concerned, this is just another blip on the radar. Trade-24 analyst, Stephen Goldfarb points out that traders largely sidestep the political gobbledygook of the Trump administration, and are focused instead on the fundamentals. ‘If we look to the White House and the West Wing, several high-ranking inner-circle White House officials are now gone, including General Michael T. Flynn, Anthony Scaramucci, Sean Spicer, Steve Bannon, Reince Priebus and more are likely to follow. This melodrama has a limited impact on market fundamentals. The US economy is fundamentally sound. Q1 2017 GDP came in at 1.2%, and Q2 2017 GDP came in at 2.6%. This data is encouraging, and it will be interesting to see which way markets will move by August 30, 2017 when the next release is announced.’

The underpinnings of the Trump presidency may be weighing heavily on market sentiment. He was propelled to victory in a nationalist fervour that no longer has any of its staunchest proponents on board with Trump. Since Trump is a populist, he may bend to media pressure and adopt a more relaxed tone in matters of state. There are concerns that discretionary spending in the US economy is slowing. A weak USD is evident across the board, and real wage growth remains slow. While unemployment continues to fall (currently at 4.3%), wages need to keep rising to grow the economy.

Source Article from http://www.hangthebankers.com/playing-politics-with-the-economy-in-the-us/

RSS Feed

RSS Feed

August 21st, 2017

August 21st, 2017  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: