Prospectors have mined 20 million ounces of gold from the Yukon’s famous Klondike since the Gold Rush. But they haven’t been able to find the original source—the multi-billion-dollar bedrock.

Until now.

A famous geologist armed with the latest in drone tech and robo-drills is certain he’s just found it.

This is the Mother Lode of Klondike gold that countless prospectors have been trying to get at for over a century.

It makes the 20 million ounces that have been collected on the surface of the seem like gold dust. A mere flash in the pan.

This is no longer a story of men with pick axes trying in vain to find the mega source that’s it’s all come from…

Now it’s a story of amazing technology that’s enraptured everyone on the Discovery Channel, a Canadian billionaire whose touch turns everything to gold, and a legendary geologist of gold-discovery fame.

The famous geologist is Peter Tallman. The company is Klondike Gold (TSX:KG.V; OTC:KDKGF), and their latest gold discoveries are the stuff of legend.

Not only are they sitting on massive acreage in one of the Gold Rush’s most pre-eminent venues, but they are also positioned in an area that has geology similar to the California Motherlode Belt, where 220 million ounces was discovered.

And the timing is urgent.

What Tallman has already discovered could be enough to make Klondike Gold a prime takeover target.

Here are 5 reasons to look at Klondike Gold (TSX:KG.V; OTC:KDKGF) right now:

#1 The Gold Discovery of the Century

Tallman believes he’s sitting on one of the sources of the historic Klondike gold fields, and he’s got plenty to prove it.

He’s tested the gold-bearing structure for 2 kilometers, and the gold is there, a source which he believes runs for 8 kilometers. He’s also identified three other gold-bearing structures—each 8 kilometers long.

What does that mean, exactly? It means they’ve got 30 kilometers of gold-bearing structure to test further.

By the end of last year, Klondike’s best drill holes showed 5 g/t over 14 meters and 76 g/t over 3 meters, keeping in mind that the industry average is 1.18 g/t.

These are phenomenal results, and Tallman is far from finished.

Right now, Klondike has three primary targets in its namesake Gold Rush venue:

• Lone Star is a 70-hole drill program, with results so far showing 2.4 g/t

• Gold Run is following up on visible gold bedrock samples from last year, with a 10-hole drill program

• Quartz Creek is continuing exploration, with 2,000 soil samples

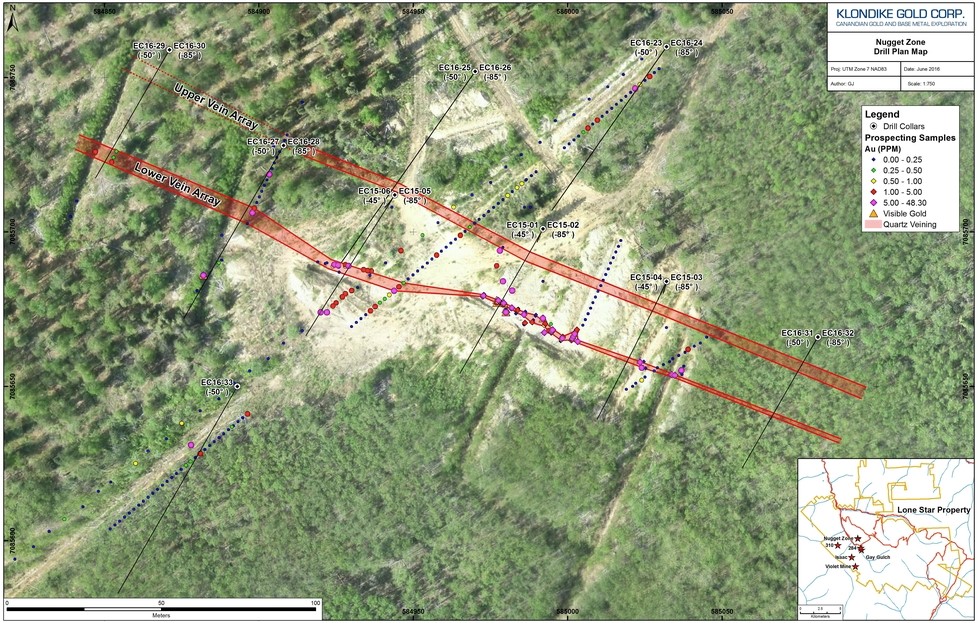

(Click to enlarge)

Tallman is looking at Lone Star directly above Bonanza Creek—one of the most prolific creeks in the Klondike. Last year alone, they drilled 14 holes here, and all of them hit disseminated gold mineralization. This is unusual even in the Klondike Gold Rush territory.

The ultimate target here is a multi-million-ounce play.

(Click to enlarge)

#2 Crazy Cheap Exploration, 100% Ownership & Takeover Potential

All told, with Klondike Gold (TSX:KG.V; OTC:KDKGF) we’re looking at 2,780 contiguous claims covering 524 square kilometers, and … this is where it gets really good: 100% ownership, which means 100% of the score on these incredible finds.

The numbers look even better when you consider that they’re paying only $75 per meter for each drill hole.

That makes this the cheapest drill program in the entire Yukon, and one of the cheapest in Canada.

The Klondike is full of gold – it is known for its gold. It is all sitting at the surface so an average drill completed a hole each day.

The brilliant infrastructure helps, as well. Their project is just 20 kilometers south of Dawson. Their compound is only 20 minutes from the drilling area. They can even order a pizza from the town (of Dawson) for delivery at the drill.

That’s why four out of five of the biggest miners in the world are gathered in the Yukon. Of the $1 billion invested in this region so far, 90% of it has been in gold.

The supermajors are all over the Yukon, and Barrick gold was the fourth to hit up this Gold Rush territory in the last 12 months.

• Barrick Gold (TSE:ABX) (NYSE:ABX) is investing $8.3 million in junior ATAC Resources’ Rackla Gold property, in a prime example of how high-potential junior gold rush property is attracting major miner attention (and money).

• Newmont Mining (NYSE:NEM) (TSE:NMC) will invest up to $53 million in Goldstrike Resources’ Plateau project.

• Kinross Gold Corporation (TSX:K; NYSE:KGC) will acquire a 19.9% interest in White Gold Corp. (TSX.V:WGO).

And the list of Yukon deals goes on …

What makes this story even better is that even if we don’t get to the Motherlode of the Gold Rush today, the discovery of any mineable deposit would send share prices soaring.

#3 The Motherlode of Technology

Why hasn’t the Klondike Motherlode of gold been found after 40 long years of searching? That’s easy: technology.

It all started in 1896, when George Washington Carmack and two Indian friends found a large gold nugget when they were fishing in what is the Yukon’s Bonanza Creek—Klondike Gold Corp’s (TSX:KG.V; OTC:KDKGF) primary target area. This gold nugget launched a massive gold rush, but the 20 million ounces scooped up wasn’t ‘mined’—it was placer gold, recovered at the surface.

The men that gathered here en masse to get rich, were armed only with pick axes. They couldn’t get to the hard rock source of the gold, and they wouldn’t have known where, or how, to look.

Tallman does.

And he’s covering every square inch of ground, and underground, here, with a systematic approach and the most advanced technology.

That includes drones, portable ground imaging, robo-drills, Field X-rays and 3D mapping.

(Click to enlarge)

What came after the pick axes was invasive heavy equipment, digging huge trenches—all coming up empty-handed.

Modern tech is fast, revealing the age-old secrets of this difficult terrain.

Advanced drones fly out over the entire territory, collecting key geological data. Once the sweet spots are determined by the drone flyovers, it’s time to see what’s under the soil. This advanced geophysical survey technology allows for the 3D imaging of slices of the subsurface in great detail by running electrical currents into the ground. This tells operators whether to drill or not to drill.

If the geophysical survey shows the gold signature, the robo-drill is ushered in. It’s fully mobile on pretty much any terrain—it doesn’t even need a road. The robo-drill brings up samples that are then analyzed on site with advanced, mobile x-ray technology.

The drone images, the geophysical survey results and the analysis are all channeled directly to Tallman’s computer at Klondike’s compound.

And gold eventually gives itself up to modern technology …

#4 Reborn into a Legend

Klondike Gold (TSX:KG.V; OTC:KDKGF) wasn’t always the stuff of legend.

At least not until Canadian billionaire and mining finance legend Frank Giustra decided, in 2014, that it was time to revive the Klondike Gold Rush. So he brought in a famous geologist to make waves where waters had grown stagnant.

Giustra, who owns 22% of the company, turned to Tallman, a technology genius with 35 years of experience and a string of phenomenal discoveries behind him.

Giustra tasked Tallman with finding out where the money went under Klondike’s previous mismanagement; and finding out whether its vast properties are profitable.

In record time, Tallman had paid off the company’s debt, cleaned house, and made a beeline for the geology—finding visible gold in bedrock right away.

The verdict: Not only was Klondike’s property ‘good’, it was exceptional: It’s sitting on channel gravels that have given up 20 million ounces of placer gold (worth $25 billion USD today).

Fast forward to less than three years later – Tallman is convinced that a fault system he’s identified along with a series of fractures extending from Bonanza Creek down to Eldorado Creek were the source bedrock of all that Gold Rush gold.

(Click to enlarge)

Giustra didn’t pick Tallman at random. The mining finance legend is known not only for being in the right place, at the right time, but for putting together dream teams to make things happen—fast.

And the ‘things’ he makes happen always include a great deal of shareholder value—tens of billions of dollars:

He built up giant Goldcorp (NYSE:GG) in 2000 and today it trades at a market cap of nearly $11 billion, and is one of the largest gold-mining companies in the world. He was also behind Silver Wheaton, which is now Wheaton Precious Metals Corp. (NYSE:WPM), the biggest silver and gold streaming company in the world.

Giustra’s 20-oscar-winning entertainment behemoth, Lion’s Gate, also took in $2.4 billion in revenue in 2015. And these are just a few of his multi-billion-dollar companies.

But back to Tallman, who owns 3.6% of outstanding shares in Klondike himself …

Tallman, the CEO and President of Klondike Gold Corp. since 2014, is not just a genius geologist, he’s a master businessman – a rare combination in the industry. So rare, in fact, that legendary businessman Murray ‘The Pez’ Pezim hired him to oversee around 80 companies in his portfolio. ‘The Pez’ put two of Canada’s premier gold deposits (Hemlo and Eskay Creek) on the world map.

In the world of geology—and gold—Tallman is a larger than life figure. And Giustra’s counting on him to continue his record of superstar discoveries with Klondike.

He’s already discovered three deposits, two of which have been mined.

But he also put his business acumen to work—with a passion. By late 2014, he had optioned one of the company’s properties off to The Discovery Channel’s ‘Gold Rush’ program, earning the Klondike C$750,000 in return and also garnering it massive exposure.

Under Tallman, the company has no debt, a tightly-held share structure and money in the bank. It’s reborn, flush, and ready to break out with the next major Gold Rush story.

#5 New Drilling Results SOON

Based on Tallman’s geology, and the rapid flow of news for Klondike (TSX:KG.V; OTC:KDKGF), we expect significant momentum on shares in the coming weeks and months.

The 2.4 g/t results from 2 holes at Lone Star on 11 July, was just the beginning of what promises to be a massive barrage of great news.

While the Lone Star project focuses full throttle on exploration, 30 holes have already been drilled this year alone, and the results will start coming in any day.

In fact, we expect major news from Klondike every week or two from now until November.

And they’re fully funded to drill 80 holes, so that’s 50 more to go and they’ll finish drilling in late October.

A recent private placement also gave them more money to spend on drilling.

The drilling results themselves are bound to attract the majors who have already shown a hearty appetite for swooping in on the juniors making waves in the Yukon Gold Rush territory.

The Klondike is the largest remaining unsourced chemical anomaly on the planet, and Tallman has parachuted in with a singular objective—to find the original source of all that gold in the bedrock.

And he’s watching what’s happening around him like a hawk. Klondike’s neighbor, Kaminak, was already bought for half a billion by giant Goldcorp. Another neighbor, Underworld, was bought by Kinross for $140 million. Both of their mining roads pass right through the middle of Klondike’s.

Bottom Line?

• Superstar team, with geology genius, advanced technology and billionaire backing

• Potential bulk gold tonnage identified

• Possible motherlode source of historical Gold Rush gold

• Fully financed and funded to drill another 50 holes

• High-speed news flow, with results expected every week from now until year-end

• Fantastic shareholder structure, with management and insiders holding over half of the company and believing in it

• If Klondike’s exceptional results prove continuity, we’ll be looking at a prime takeover target and a potentially significant shift in share prices heading into the third quarter of this year and the first quarter of 2018.

Honorable Mentions

Royal Gold (NASDAQ:RGLD): Royal Gold is engaged in the acquisition, and management of precious metals royalties and streams. Royal does not only focus on gold, it also has royalty claims on silver, zinc, copper and lead in over 20 countries. As commodity prices rise, we expect that more of its unexplored properties will come into production.

Gold Fields Limited (NYSE:GFI): South African Gold Fields produced 2.15 million oz. of gold equivalent in 2016, slightly lower than its 2015. It owns and operates mines in South Africa, Ghana, Australia and Peru. Its growth efforts are focused mainly in the regions where it already has a footprint and are mainly driven through brownfields exploration. Unlike its smaller counterparts, Gold Fields yields a modest dividend.

Silver Wheaton (NYSE:SLW): Silver Wheaton Corp. is a pure play silver mining company, and the largest in the business of silver streaming. It produces over 26 million ounces and sells over 29 million ounces of silver mined by other companies such as Barrick and Goldcorp as a by-product of their main operations. Wheaton pays a healthy dividend and has actually profited from the most recent downturn in commodities.

AngloGold Limited (NYSE:AU): AngloGold is a major gold company, mining some 7 million ounces a year, with estimated reserves of 126 million ounces. The company operates in 11 countries. The company’s stock fell steep over the last few months, but a rebound could be on the horizon as gold prices are rising again.

IAMGOLD (NYSE:IAG, IMG.TO): IAMGOLD is a fast growing mid-tier gold miner with the ambition to become a major gold miner. The company produced some 214,000 ounces in Q1 2017 from its operations in South America and Africa. In June, this promising miner closed a deal with Japanese commodity giant Sumitomo to develop an Ontario gold project. The company saw its stock price fall earlier this year, but is poised for gains as gold is rallying

You can find more information on Klondike Gold Corp here: (TSX:KG.V; OTC:KDKGF)

By. James Burgess

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not

and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for

any investment. No information in this Report should be construed as individualized investment advice. A

licensed financial advisor should be consulted prior to making any investment decision. We make no

guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or

completeness. Expressions of opinion are those of Oilprice.com only and are subject to change without

notice. Oilprice.com assumes no warranty, liability or guarantee for the current relevance, correctness or

completeness of any information provided within this Report and will not be held liable for the

consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore,

we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which

you may incur as a result of the use and existence of the information, provided within this Report. All

content contained herein is subject to the terms and conditions set forth in the original article posted on

Oilprice.com and subject to the terms and conditions therein.

Source Article from http://feedproxy.google.com/~r/blacklistednews/hKxa/~3/WbbV49yVqnE/M.html

RSS Feed

RSS Feed

August 21st, 2017

August 21st, 2017  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: