By Jeff Paul

By Jeff Paul

The US Dollar is quickly weakening compared to commodities, cryptocurrencies and other national currencies. Is it a normal cycle? Or is it something more serious this time?

Economist and money manager Peter Schiff recently summarized the current trajectory and consequences of the falling dollar in this tweet:

The U.S. dollar Index just broke below 90. Which will happen first, Dollar Index breaks below 80, Gold breaks above $1,500, 10-year treasury yield rises above 4%, or oil prices rise above $100 per barrel? What happens to the stock market & the economy if all 4 happen this year?

— Peter Schiff (@PeterSchiff) January 24, 2018

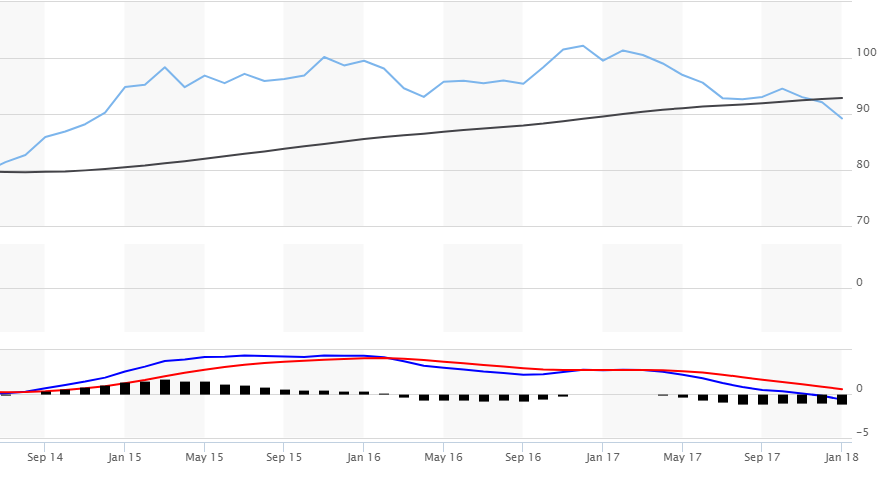

The dollar has fallen to its lowest level on the US Dollar Index (DXY) since December 2014:

4-year DXY chart from MarketWatch

The US Dollar is considered one of the least-worst national fiat money in times of financial crisis because of its petro-dollar status as the world’s reserve currency. Yet everyone is beginning to understand that it will eventually lose that status and its dominance. But when?

The recent peak in the strength of the petro-dollar was also marked by a low of $40.59 for a barrel of oil in January 2016, and it has been on a clear march higher for the past six months.

3-year Oil Price Chart from MarketWatch

And, of course, many readers of this site are well aware of how the dollar has weakened against cryptocurrencies this past year. Bitcoin began 2017 at $1,000. After peaking above $20,000 per bitcoin, today you need over $10,000 to buy one bitcoin.

1-year Bitcoin (BTC) chart from CoinMarketCap

Call it a bubble if you want. Cryptocurrency supporters will say it’s the 100-year national currency bubble that’s finally popping.

The weakening dollar seems to be accelerating, and the trend will create opportunities for savvy FOREX traders. I like to use a forex trading practice account to test my theories. However, most of my real money is in cryptocurrency these days because they have stronger technical behavior of a free market.

When the dollar begins to fall and commodities rise, the currencies that usually gain in value tend to be resource-rich nations like Canada and Australia. This has been the cycle for decades. So we should expect their dollars, respectively, to continue to strengthen against the US Dollar as this trend accelerates.

Another currency to watch is the Swiss franc. Switzerland may not be rich in natural resources, but they are rich in assets. The Swiss franc is quasi-backed by a portfolio of assets including $90 billion in stocks bought by the Swiss National Bank since 2008, as reported in article in QZ, “The Swiss central bank’s $90 billion stocks portfolio is insane”:

Since the financial crisis of 2008, central banks around the world have printed money and purchased assets as an aggressive way to stimulate the economy. But none more so than the Swiss National Bank (SNB).

The SNB has $836 billion of assets on its balance sheet. This isn’t huge as far as central banks go. The Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BOJ) all have five to six times that amount on theirs; the Fed alone has assets of $4.5 trillion (pdf). But the SNB’s balance sheet is striking compared to the size of the Swiss economy. The totality of the assets held by the Fed, the ECB, and the BOJ’s work out to 23%, 40%, and 90% of their countries’ annual GDP, respectively; the SNB’s assets are a full 127% of the Swiss GDP.

That means that the SNB has invested a quarter more than its entire economy produces in a year.

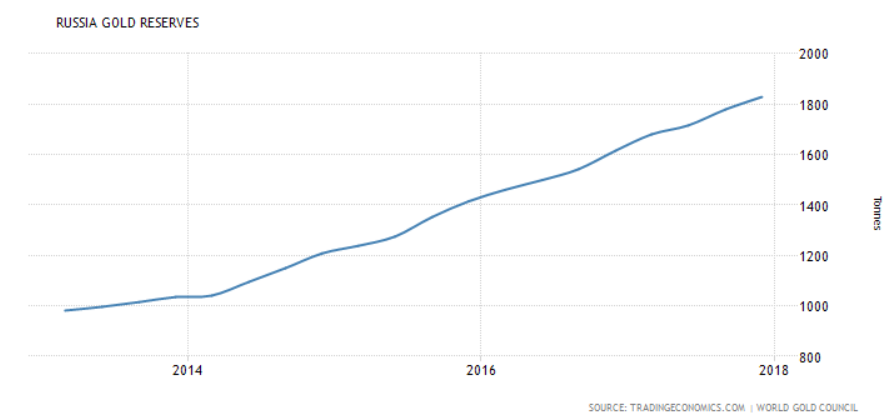

If this trend is not cyclic, but rather the beginning of the end for US Dollar dominance, nations with the deepest stack of physical gold may also see their currencies increase in value relative to the dollar. Russia has been increasing its gold reserves and has an abundance of oil and natural gas as well. Thus, the ruble could climb further.

5-year chart of Russia Gold Reserves – Source

Even the euro has climbed 20% against the dollar since its low in December 2016.

‘Good’ #euro morning! The euro is now up 20% against the #USD from the low in December 2016. Did #Draghi sleep well last night? pic.twitter.com/FuWFtYAmi0

— jeroen blokland (@jsblokland) January 25, 2018

And it may spell trouble for the US economy. Peter Schiff thinks it will be a disaster:

The new weak #dollar policy will be a disaster for the United States. If the dollar Index fell from 120 to 70 when we had a “strong dollar policy,” imagine how much lower it will go with a weak dollar policy! My guess is 40.

— Peter Schiff (@PeterSchiff) January 24, 2018

US Treasury Secretary Steve Mnuchin disagrees. He told reporters at Davos, “Obviously a weaker dollar is good for us as it relates to trade and opportunities.” He added that the dollar’s short term value is “not a concern of ours at all.”

This even shocked IMF head Christine Lagarde, who said, “I really hope that Secretary Mnuchin has a chance to clarify exactly what he said,” at the World Economic Forum meeting in Davos, Switzerland. “The dollar is of all currencies a floating currency and one where value is determined by markets and geared by the fundamentals of U.S. policy.”

People still don’t get it. The only reason the economy “recovered” is that a rising dollar kept interest rates low and consumer prices in check, allowing America to go deeper into debt and consumers to keep spending. As the dollar sinks the economy will go down with it.

— Peter Schiff (@PeterSchiff) January 25, 2018

Whether it is cyclic or indeed the end of dollar dominance; gold, silver, cryptocurrency, oil and some foreign currencies will likely continue to climb in the short term as the value of the US Dollar decreases.

Jeff Paul writes for Activist Post and is the editor of Counter Markets newsletter for libertarian entrepreneurs.

Source Article from http://feedproxy.google.com/~r/ActivistPost/~3/YARwu_5Zdj8/us-dollar-weakens-against-commodities-and-other-currencies.html

RSS Feed

RSS Feed

January 30th, 2018

January 30th, 2018  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: