By Jeff Paul

I spent three years in Hawaii. It’s obscenely expensive to live there. Real estate, food, electricity, health care, and travel costs are significantly higher in Hawaii than on the mainland. And incomes aren’t rising fast enough to match rising cost of living. As a result, many natives rely on government aid to survive. This week, Hawaii passed a new measure to study the universal basic income (UBI) as an attempt to address this problem.

But will it make costs even higher?

The bill, House Concurrent Resolution 89, declares that all families are entitled to basic financial security and empowers a number of government offices to evaluate universal basic income options.

Hawaii state representative Chris Lee wrote on Reddit that the measure will “analyze our state’s economy and find ways to ensure all families have basic financial security, including an evaluation of different forms of a full or partial universal basic income.”

Presumably they’ll study what an adequate “full” UBI would be to live in Hawaii. I can save them some time.

The Missouri Economic Research and Information Center (MERIC) ranks Hawaii the most expensive state (ahead of Washington D.C.). Analysis of their 2014 study determined that you need to make $122,000 a year to live in Hawaii.

All of those costs are surely higher today than in 2014, especially real estate which continues to set new record high prices. Although the median household income in Hawaii is higher than most of the nation at $73,486 per year, the shortfall of what’s needed is still tremendous.

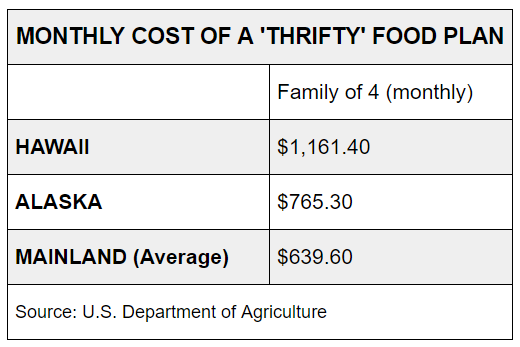

A quick look at the cost of food gives us a sense of the challenges Hawaiians face. According to the USDA, a “thrifty food plan” for a family of four in Hawaii costs $1,161/month, almost double the cost of the same food plan on the mainland.

Hawaii’s food stamp program SNAP bragged that they helped 98,440 families in 2014. That’s around a quarter of all households in Hawaii. Hawaii already offers the highest welfare benefits in the country, equivalent to a pre-tax salary of over $60,000 per year, or about $29.13 per hour.

Hawaii already offers the highest welfare benefits in the country, equivalent to a pre-tax salary of over $60,000 per year, or about $29.13 per hour.

Why would anyone work in Hawaii?

Proponents of the UBI say it will be more efficient, thus more cost effective, than existing welfare programs and they claim it will be necessary to mitigate the effects of job automation. However, it seems Hawaiians would require a UBI higher than $60,000 per year to survive without a job. So it’s unclear how that would be less expensive or more efficient.

Hawaii should be careful because politicians’ reactions to problems often feed those very problems. The UBI may have the opposite effect of its intended purpose. Free-market economists point out that high welfare benefits drive the cost of living higher because they create artificial demand for goods and services that wouldn’t exist if not for government intervention.

It’s like raising the minimum wage to cope with higher living costs caused, in part, by higher labor costs. Or how the cost of college exploded when government intervened with easy student loans. Or how the cost of health insurance exploded when government forced participation. In that same way, an artificial guaranteed income high enough to survive in Hawaii will increase prices on everything for everyone — including massively raising taxes.

I oppose the UBI for moral and pragmatic reasons, as clearly stated by Bryan Caplan of the Foundation for Economic Education:

- Forced charity is unjust. Individuals have a moral right to decide if and when they want to help others.

- Forced charity is unnecessary. In a free market, voluntary donations are enough to provide for the truly poor.

- Forced charity gives recipients bad incentives. If the government takes care of you, you’re less likely to take care of yourself.

- The cost of forced charity is high and growing rapidly, leading to a future of exorbitant taxes or financial crisis.

All of the good feels one may get by being charitable with other people’s money won’t change the consequences of a future with bad incentives and exorbitant taxes or financial crisis.

It’s unclear how the Hawaiian government could pay for the UBI. In addition to federal taxes, workers in Hawaii already pay ridiculously high property taxes, a high state income tax (8.25%), a state sales tax (4+%), and one of the highest gas taxes in the nation (60.39 cents per gallon).

I went ahead and calculated what it would cost Hawaii to give every resident a UBI of $33,000 per year. It was easy to calculate because it’s the same amount that each man, woman and child already owes on Hawaii’s state debt – $46 billion – or $33,111/resident (2014). If they aim to give people money, they’re going in the wrong direction.

Jeff Paul writes for Activist Post and Counter Markets newsletter. This article is Creative Commons. You may republish in full with attribution and link to this post.

Source Article from http://feedproxy.google.com/~r/ActivistPost/~3/55JDI_NkE9o/you-think-hawaii-is-expensive-now-wait-until-universal-basic-income.html

RSS Feed

RSS Feed

June 21st, 2017

June 21st, 2017  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: