It seems tasteless to talk about prices while the maw of Russia is spewing death and destruction upon Ukraine. Inflation, however, is very much now connected to what happens in that conflict.

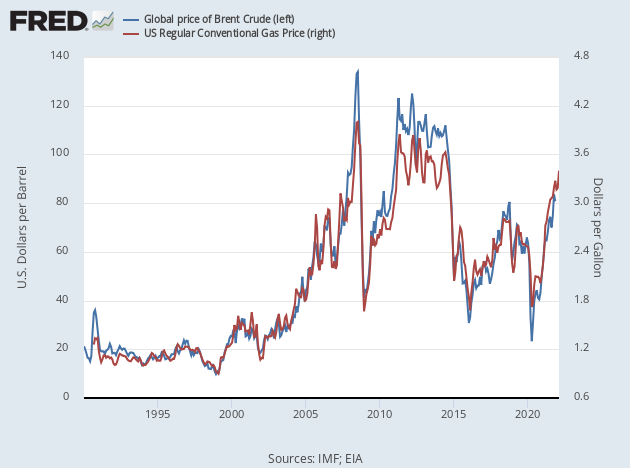

Let’s start with the prices of oil. These jumped on Monday, with West Texas Intermediate at one point punching above $130 a barrel, and Brent Crude stopping just short of $140 a barrel. Those prices are close to the record highs hit back in 2008 but only if you do not adjust for inflation. The 2008 high of $143.67 would be $186.73 in today’s dollars. That means that although prices might be as high in nominal terms as they were 14 years ago, the economic drag is not as severe. The odds, however, are in favor of prices going even higher, especially as pressure mounts on the Biden administration to sanction Russian oil.

Gas prices rose above four dollars at the end of last week, and on Monday the national average was just six cents below the 2008 high. This has led to grumbling by drivers wondering if the gas stations are somehow taking advantage of the situation to gouge customers. That’s an accusation we can easily dismiss. Over the longterm, the price of a gallon of gasoline is about five percent of the price of a barrel of Brent crude. Today, prices at the pump are 4.8 percent of the prices of Brent. So gas is actually tracking below its average relationship to oil.

It’s a common misconception that high gas prices are good for gas stations. High gas prices leave customers with less money to spend on higher-margin items like snacks, drinks, and vaping equipment. There’s some evidence that higher prices alienate customers, leaving them less likely to want to make purchases at the local gas station. In fact, several economic studies have shown that it is not rising prices that help out the gas station but falling prices. When the price of oil falls, the prices of gasoline declines but typically not as rapidly. This leaves the gas station with a short period of extra profit in what is otherwise a business of extremely thin margins. According to one study, the average privately-held gas station makes only two cents of profit on each dollar of sales.

Keep in mind that the cars we drive in 2020 are far more fuel-efficient than the cars we were driving in 2008. That alleviates the financial stress inflicted on households by higher gas prices.

Rising gasoline prices, however, also drive up expectations for broader inflation. A 2020 study by economists at the Federal Reserve Bank of Dallas found that the rise in household inflation expectations between 2009 and 2013 is almost entirely explained by a large increase in gasoline prices during the period. Since inflation expectations are thought to have a big influence on inflation itself, it’s easy to see that gas prices are very likely adding to inflationary pressure in an economy already beset by 40-year high inflation. In that way, we’re much worse off today than 2008, when inflation peaked at 5.5 percent.

We’ll get a look at how high inflation climbed in February on Thursday. The consensus is for prices to have climbed 7.9 percent year over year, up from 7.5 percent in January. Core inflation, which excludes food and energy, is expected to come in at 6.4 percent year over year, up from the prior month’s 6.0 percent. Given the very hot February jobs number released last week, the consensus forecasts may be on the low side.

Of course, wherever the number comes in, it’s likely only a foreshadowing of even more inflation ahead due to the battle for Ukraine and what that has meant for oil prices.

RSS Feed

RSS Feed

March 8th, 2022

March 8th, 2022  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: