BY RHODA WILSON ON AUGUST 30, 2022 • ( 5 COMMENTS )

Former Bank of England chief Mark Carney was the most influential central banker in the world. He has held the most senior positions in global central banking in the shortest period of time and is probably more responsible than any other figure – except possibly his billionaire partner Michael Bloomberg – for the current rampage of environmentalist assaults on modern industrial society.

Since his speech at the 2015 UN COP21 conference (cradle of “The Paris Accord” on climate change), Carney has imposed an anti-industrial direction on the policy of most major central banks in the world, even as their power relative to governments has grown.Mark Carney: The Prince (Charles) of Central Bankers, Paul Gallagher, 18 October 2019

Let’s not lose touch…Your Government and Big Tech are actively trying to censor the information reported by The Exposé to serve their own needs. Subscribe now to make sure you receive the latest uncensored news in your inbox…

Follow The Exposé’s Official Channel on Telegram here

Join the conversation in our Telegram Discussion Group here

Carney wrote an article in the Guardian published on 17 April 2019, “If some companies and industries fail to adapt to this new [anti-carbon] world, they will fail to exist.”

So enamoured of his own phrase, he repeated it five months later in his UN Climate Action Summit speech on 23 September 2019: “Firms that align their business models to the transition to a net zero [carbon] world will be rewarded handsomely. Those that fail to adapt will cease to exist.”

He also told the Climate Action Summit that all investments, at least all energy-related investments, will have to become green to be permitted – one of “50 shades of green,” as he put it.

On 22 September 2019, the day before the Climate Action Summit, he gave a speech during what law firm Lathan & Watkins referred to as an “insurance industry event” in which Carney said: “Changes in climate policies, technologies and physical risks in the transition to a net zero world will prompt reassessments of the value of virtually every asset. The financial system will reward companies that adjust and punish those who don’t.”

At this point, it’s worth recalling that Carney, in his opening speech at the City of London’s 2020 Green Horizon Summit, said that total net zero transition represents “the greatest commercial opportunity of our time” and “our objective for COP26 is to build the framework so that every financial decision can take climate change into account.”

Every financial decision means EVERY financial decision. Carney has led the campaign for a green digital crypto-currency to replace the US dollar. Since his announcement of this crypto plan on 22 August 2019, the Bank of Canada quickly fell into line declaring its support of the agenda.

Carney’s colleagues in the United Nations Conference on Trade and Development amplified this message a couple of months later saying:

“What is needed is a Global Green New Deal that combines environmental recovery, financial stability and economic justice through massive public investment in decarbonising our energy, transportation and food systems while guaranteeing jobs for displaced workers and supporting low carbon growth paths in developing countries… through the transfer of appropriate technologies”.

As if to demonstrate he aims to control EVERY financial decision and transaction, earlier this year Carney wrote an article published in The Globe and Mail where he weighed in on the Canadian Freedom Convoy who were standing up for rights and freedoms. “It’s time to end the sedition in Ottawa by enforcing the law and following the money,” he wrote. He continued:

“The goals of the leadership of the so-called freedom convoy were clear from the start: to remove from power the government that Canadians elected less than six months ago. Their blatant treachery was dismissed as comic, which meant many didn’t take them as seriously as they should have … now in its second week, no one should have any doubt. This is sedition. That’s a word I never thought I’d use in Canada. It means “incitement of resistance to or insurrection against lawful authority.

“Those who are still helping to extend this occupation must be identified and punished to the full force of the law … Drawing the line means choking off the money that financed this occupation.”

He is not referring to financial organisations or companies disobeying his “green” rules, but citizens who have the right to protest. And so there it is, in black and white from the former Governor of the Bank of England – if you don’t obey the state’s diktats, you should be punished. However, considering that eco-fascist Mark Carney’s definition of “climate change” and “green” is a fraud as is his mission to commercialise it, it’s not surprising that Dr. David Martin named him as one of the 36 people who are killing humanity.

The Rise of Mark Carney

Paul Gallagher, co-editor of Executive Intelligence Review, described Carney as a “genius not born but appointed.” Gallagher’s article, which goes into more detail than we have below, is well worth the read.

Carney rose from an Irish-Canadian background and was educated at Harvard and Oxford. He began his banking career with 13 years at Goldman Sachs (1990-2003) in London and Tokyo. At Goldman, Carney was a trader and advisor, and eventually became managing director of investment banking. While at Goldman Sachs he helped post-apartheid South Africa gain access to international bond markets and advised Russia as it navigated a financial crisis in 1998.

From 2004-08 Carney, in an unusual combination, was both Deputy Governor of the Bank of Canada, and Deputy Finance Minister of Canada. In February 2008, Carney, at 41, was appointed Bank of Canada Governor, chosen over a 35-year veteran of the Bank who was considered most likely to get the job.

In 2011 he was appointed Chair of the Financial Stability Board (“FSB”). The FSB was formed by the G20 in 2009, the year after the 2008 global financial crisis, as a successor to the Financial Stability Forum. The FSB was assigned a number of tasks, working alongside the International Monetary Fund, World Bank, and the World Trade Organisation.

Carney served two three-year terms as FSB Chair and then was extended for another year. In 2010, he had already been appointed as Chairman of the Bank for International Settlements (“BIS”) Committee on the Global Financial System and in 2012 was appointed head of the Bank of England (“BoE”), a position he held until March 2020. So, in effect, Carney held four key global central bank positions at the same time.

Again, in becoming Governor of the Bank of England, as when he was appointed to head the Bank of Canada, Carney was chosen, by Bilderberg enthusiast George Osborne, former Chancellor of the Exchequer, over a veteran executive of the Bank, Andrew Haldane who was at the time Executive Director for Financial Stability at the Bank of England.

Both Carney and Osborne have attended meetings of the Bilderberg Society but Haldane has not. Although Osborne’s last attendance was in 2018 – which happened to be the first year Carney attended – Carney attended this year’s 68th Bilderberg meeting. On the list of Bilderberg attendees, Carney was simply described as “Vice Chair Brookfield Asset Management.” Brookfield claims to be the “pioneers of long-term impact” whose global platform provides innovative solutions to help governments and businesses meet their decarbonisation goals.

[As Brookfield’s Vice Chair], he is focused on the development of products for investors that will combine positive social and environmental outcomes with strong risk-adjusted returns.

He is a long-time and well-known advocate for sustainability, specifically with regard to the management and reduction of climate risks, and is currently the United Nations Special Envoy for Climate Action and Finance and Co-Chair for the Glasgow Finance Alliance for Net Zero.

He is also an external member of the Board of Stripe, a member of the Global Advisory Board of PIMCO, the Group of Thirty, Harvard University, Rideau Hall Foundation, Bilderberg, the Foundation Board of the World Economic Forum, the boards of Bloomberg Philanthropies, the Peterson Institute for International Economics the Hoffman Institute for Global Business and Society at INSEAD, Cultivo, as well as Senior counsellor of the MacroAdvisory Partners, Advisor of the Watershed, and Chair of Chatham House. [emphasis our own]Brookfield Global Asset Management, Biography Mark Carney, retrieved 29 August 2022

According to Matthew Ehret, the Round Table took form, especially, with the creation of Chatham House. And Chatham House has been an underappreciated branch of the reconquering, the recolonisation, of the United States.

In 2012, the same year that Osborne appointed him the first non-Briton Governor of the Bank of England, Carney became a coordinator of the Davos World Economic Forum (“WEF”). Currently, Carney is on WEF’s Board of Trustees and remains a member of WEF’s Foundation Board.

Carney’s Power Grab

“Britain’s regulatory mandarins rejoiced [in the autumn of 2012] when Bank of Canada governor Mark Carney, the “rock star” of central banking — could there really be such a thing? — accepted the job of head of the Bank of England,” The Huffington Post wrote in 2013. “Now, the UK government is preparing to give Carney a seemingly unprecedented amount of power for a British central banker.”

In response to the 2008 global financial crisis – so that if the investment side ends up facing financial collapse, it won’t affect the banks’ retail customers – bank reforms revealed by Osborne placed Carney’s Bank of England in charge of regulating the banks and given the power to break up those banks that failed to live up to designed rules. Then Prime Minister David Cameron said: “The Bank of England will be the super cop of our financial system.”

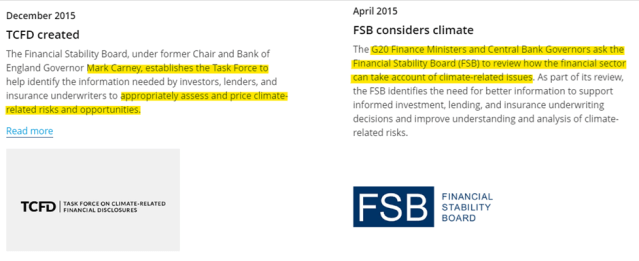

Two years later Carney led the creation of FSB’s Task Force on Climate-Related Financial Disclosure (“TCFD”).

The central banks of the FSB, headed by Carney, appointed 30 people to form the TCFD, including green billionaire Michael Bloomberg as its chairman. This is how some former central bankers, now executives at BlackRock, became leaders of TCFD and began the work of “taxonomies,” or classification of companies according to their “climate risk level.”

TCFD also included executives from Barclays Bank; HSBC, the City of London; Swiss Re; and Al Gore’s partner David Blood. The stated purpose of this task force was “to provide information and to advise investors, lenders and insurers about climate-related risks.”

Here, Carney and Bloomberg were already starting a power grab by central banks. Their mandate does not include advising investors, or any others, about climate. Suppose they had said “political risks” or “terror threats” or “the risk of war”? Central banks do not advise or regulate on such matters – until Carney decided they did.

As of January 2022, TFCD had 3400 supporters in 95 jurisdictions.

Green Finance Initiatives

From the TCFD came the Green Finance Initiative (“GFI”) to generate and support “green bonds.” So now the central banks were also advising on technologies in which to invest or not invest.

As noted in research briefings for a debate in the House of Lords on 18 January 2018, the GFI was established in January 2016 by the City of London Corporation in partnership with the UK government. In 2017, the Government announced the establishment of a Green Finance Taskforce and its continued support for GFI. The briefing also noted that: “The Bank of England has argued that the financial risks stemming from climate change are [ ] relevant to the mandates of central banks.”

In 2019, as a direct response to a 2018 recommendation made by the UK government’s Green Finance Taskforce, the Green Finance Institute was established whose funders include the UK government and the City of London.

Networks of Central Banks and Supervisors

The Central Banks and Supervisors Network for Greening the Financial System (“NGFS”) was founded to help its members meet the goals of the Paris agreement and enhance the role of the financial system to manage risks and mobilise capital for “green and low-carbon investments.” It encourages companies to disclose climate risks in line with TCFD recommendations.

It was established in December 2017 as an initiative of La Banque de France at the Paris “One Planet Summit.” Starting with 8 central banks and supervisors, by April 2019 the NGFS had grown to 34 members and 5 observers from all over the globe.

In September 2019 the International Monetary Fund joined as an observer. In December 2020, the US Federal Reserve joined NGFS as a member as did the Federal Housing Finance Agency in May 2022. TFCD’s website shows the group now comprises 72 central banks and observers.

However, according to the NGFS website as of 14 June 2022, the NGFS consists of 116 members and 19 observers.

As noted by Mainstreaming Climate in Financial Institutions: “The NGFS has developed a broad set of analyses and practical tools, including “the NGFS Climate Scenarios” (the scenarios), which have been developed to provide a common starting point for analysing climate risks to the economy and financial system.”

Who or what Mainstreaming Climate in Financial Institutions is, brings us back to the beginning of our article – COP21. Although Mainstreaming Climate’s website doesn’t say as much, on 7 December 2015, during COP21 was a side event titled ‘Mainstreaming Climate Change Within Financial Institutions’ which launched the Climate Action in Financial Institutions Initiative. “Climate mainstreaming,” according to their definition, is the systematic integration of climate considerations throughout a financial institution’s strategies and operations.

Capitalising On Us, We Are the “Climate Risk”

Carney, as head of the BoE, expected to be able to give orders – technological, political and financial – in the UK and worldwide. He presented the effects of his orders as if they were the “reality of climate change” that all banks and companies must face up to, Paul Gallagher wrote.

Carney, the UK’s central banker, is giving orders on energy technology to companies and governments all over the world, through other central bankers who follow him and through private banks.

If they follow those orders – and Carney said this week at a Tokyo conference they will become mandatory “climate risk disclosures” by 2021 – the sources of 60% of the world’s energy and power (85% in Africa) will be progressively shut down and replaced by far less powerful, less reliable “renewables”—wind and solar.

Electricity use per capita will fall in developing countries, and, as [Executive Intelligence Review] has shown, without adequate electricity, tens of millions of people live shorter lives, and tens of millions of children die.Mark Carney: The Prince (Charles) of Central Bankers, Paul Gallagher, 18 October 2019

Confronted on this eco-fascist ideology at the UN by Daniel Burke, Carney denied it and hurried away. So far out on the “climate emergency” limb had Carney gone, and presumed to use his power to “direct investments appropriately,” that Politico published an article about him in 2018:

It was under his direction that [FSB] recommended all listed companies disclose any risk they face from climate change in their annual financial filings – and spelt out how exactly they should do it. The report was produced by the FSB’s Task Force on Climate-Related Financial Disclosures (TFCD), set up in 2015 by Carney and overseen by former New York Mayor Michael Bloomberg.Mark Carney, eco-warrior, Politico, 24 October 2018

Capitalising On the World’s Natural Assets

The alliance called Glasgow Financial Alliance for Net Zero (“GFANZ”) is part of a broader plan to “transform” the global financial system and was launched in April 2021 by:

- John Kerry, US Special Presidential Envoy for Climate Change;

- Janet Yellen, US Secretary of the Treasury and former chair of the Federal Reserve; and

- Mark Carney.

Carney, who was also the UK prime minister’s Finance Advisor for the COP26 conference, co-chairs the alliance with Bloomberg.

Principals of GFANZ, including BlackRock’s Larry Fink who is also on WEF’s Board of Trustees, have long been enthusiastic about the prospects of Natural Asset Corporations and other related efforts to financialise the natural world and he has also played a key role in marketing such financialisation as necessary to combat climate change.

UK prime minister Boris Johnson described GFANZ as “uniting the world’s banks and financial institutions behind the global transition to net zero.”

Banks and asset managers representing 40% of the world’s financial assets have now pledged to meet the goals set out in the Paris climate agreement, Bloomberg UK reported in November 2021. “More than 450 firms representing $130 trillion of assets now belong to the Glasgow Financial Alliance for Net Zero, almost double the roughly $70 trillion when GFANZ was launched in April.”

In the event that Twitter removes Burke’s thread, we have downloaded and attached a copy below.

Thread-by-@Burke4Senate-on-Thread-Reader-AppDownload

Though GFANZ has cloaked itself in lofty rhetoric of “saving the planet,” its plans ultimately amount to a corporate-led coup that will make the global financial system even more corrupt and predatory and further reduce the sovereignty of national governments in the developing world.

Read more: A Destructive Plan to Transform the Global Financial System Under the Guise Of “Climate Change”

What is the Solution

During a 2021 Schiller Institute podcast, Paul Gallagher explained the “Regime Change” Central Banks are implementing:

“The immense wall street asset management firm BlackRock [ ] is counted on by Prince Charles and the great reset oligarchs to force thousands of companies out of fossil fuels and out of carbonised industrial processes and into wind parks and solar farms … [timestamp 13:04]

“In August of 2019 central bankers met at the federal reserve’s annual Jackson Hole Wyoming conference and discussed a proposal by former central bank leaders from four countries now all executives at BlackRock … They called it ‘Regime Change.’ It was time, they said, for central banks to take control of spending powers from governments.

“The conference also discussed the presentation by Bank of England’s head, Mark Carney … who said the central banks would have to create a synthetic world currency they controlled to replace the US dollar … The reason for both proposals is to set off inflation – they must create huge amounts of consumer demand by printing money and directly helicoptering it out.

“The truth, of course, was that governments needed to create demand for capital goods, new technologies and productive employment in the way that Lyndon LaRouche had laid out [in 2010 after the 2008 global financial crash].”

Schiller Institute: Central Bank Regime Change (aka The Great Reset): Then and Now, 5 July 2021

_______________________________

It’s finally here, the Global Walkout begins September 4th at 8pm London time and continue every weeks.

One step at a time, hand in hand, we are walking out from the globalist society they are trying to enslave us into

ANYONE can participate

ANYWHERE in the world

JOIN or read about it here – https://globalwalkout.com

If you like our work please consider to donate :

_______________________________

If you are looking for solutions (lawyer, form, gathering, action, antidote, treatments, maybe this could help you:

HERE

If you want to fight back better:

https://childrenshealthdefense.org/child-health-topics/health-freedom/defender-days-sticker-gallery/

Find the others: www.freedomcells.org

Spike Protein Protocol

Glutathione (most important for body detoxification) or better

NAC = N-Acetyl-Cysteine 600-750mg (causes the body to produce glutathione itself)

Zinc

Astaxantin 5mg (also improves vision)

Quercetin

vitamin D3

Milk thistle (also liver and stomach protection)

Melatonin 1mg to 10mg (against 5G)

Alternatively CDS/CDL and zeolite

Dr. Zelenko’s Protocol contains Ivermectin, Hydroxychloroquine (HCQ), Zinc, Vitamin D3, and Quercetin.

How to find the truth :

Search engine: https://metager.org/ https://presearch.org/ or https://search.brave.com/

Videos: www.brandnewtube.com

www.odysee.com

www.bitchute.com

Facebook style: www.gab.com

RSS Feed

RSS Feed

September 3rd, 2022

September 3rd, 2022  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: