December 21, 2014

Monetary reformer Anthony Migchels endorses

two new documentaries available on YouTube

saying “they certainly widened my horizons.”

Understanding how we are controlled is necessary

to breaking free.

by Anthony Migchels

Two Brilliant Films

(abridged by henrymakow.com)

Two new films perfectly expose how the financial system dominates the globe by centralizing wealth and power through Usury, the manipulation of money, and credit allocation.

They prove history is not a matter of competing nation states, but of a shadowy elite that rules the world through control of money. We are indeed slaves and the Matrix owns us, lock, stock and barrel.

Understanding how it all came about is impossible without a basic grasp of how their control of money governs our lives.

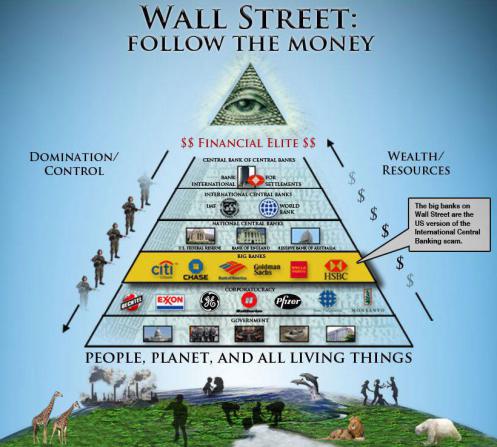

(left. The pyramid of power)

(left. The pyramid of power)

These two films, ‘Renaissance 2.0 – Financial Empire’ and ‘Princes of the Yen, Central Banks and the Transformation of the Economy’ paint a crystal clear picture of the main issues. They certainly widened my horizons.

The first focusses on the effects of Usury, the second on how Central Banks create booms and busts. It also explains in simple and direct terms what power there is in credit allocation.

This film was created by Damon Vrabel. Here’s an interesting article by him on Usury. His basic take is very sound, focussing on its exponential nature:

“The exponential math not only creates exponential debt growth, but also exponentially increasing:

Scale – government and businesses keep getting bigger; we get smaller and local communities lose their meaning

Velocity – the hamster wheel keeps spinning faster; human life suffers

Consumption – we buy more and more things that break more quickly

Production – we make more and more things that break more quickly

Inflation – the dollar buys less and less; we can’t seem to make progress

None of these things have to happen in an economic system. They only happen in ours because of debt-based money, usury, that greatly benefits the top of the pyramid while everyone else suffers according to their level in the pyramid.

So this system is guaranteed to fail due to not only the impossible math, but also the fundamental immorality. Taken together those five issues paint a horrible picture.”

The film is basically a presentation he put together. It’s well done, with clear cut visuals that center around the pyramid of power. It greatly helps to keep this picture in mind always. It’s simply the nature of power and it’s behind all their schemes, from Libertarianism to Marxism.

Vrabel points at the two tier society that is automatic with Usury. He discusses many interesting dynamics of the monetary system, pointing at the different implications for those in their respective layers of the pyramid. For instance how cost for capital rises when you go lower into the pyramid.

Vrabel points at the two tier society that is automatic with Usury. He discusses many interesting dynamics of the monetary system, pointing at the different implications for those in their respective layers of the pyramid. For instance how cost for capital rises when you go lower into the pyramid.

Another great feature is his critique of ‘modern economics’. He makes a solid case, showing once more how ridiculous it all really is. It’s very important. We must rid ourselves of the heinous nonsense that they pay their academics to produce. It’s all nonsense, existing only to explain why we must be in bondage.

—-

Whole article and discussion of the second film appear here

Anthony

Migchels is an Interest-Free Currency activist and founder of the

Gelre, the first Regional Currency in the Netherlands. You can read all

of his articles on monetary reform on his blog Real Currencies.

Related:

How Usury Encloses The Commons

Banking Is Institutionalized Murder!

Capitalism Is Jewish Usury

Rationalizing Usury: the Time Value Hoax

Derivatives, Or: How The Money Power Created The Greatest Depression

The Goal of Monetary Reform

Understand that the Banking System is One

The Silly Pseudo Science that is ‘Modern Economics’

First Comment from Tony B:

I find it interesting that this sort of thing is always very much “old news” but always also “new news.” People in any numbers just don’t seem to be able to accept that the money systems in most of the world are purposely dysfunctional for the very reasons almost always presented. Even when the people themselves obviously suffer those named symptoms.

Creating real money for exchanges needed in life is such a simple matter that anyone opposing it should be at least imprisoned as an enemy of right order.

Also, “credit allocation” is a nonexistent problem when the phony credit game is replaced by real money SPENT or GIVEN into circulation, there to stay. There was no “credit allocation” with greenbacks. Like any real money, they existed in circulation to be used free of charge by whomever acquired them after being SPENT into existence. Too many money “reformers” cannot separate the movements of credit and the differing movements of proper money in their thinking. Credit is someone else’s property being loaned at a price. True money is NOT loaned by its creator, it is spent for goods/services or given away.

Comments for “Migchels – The Matrix is Made of Money”

Elm said (December 21, 2014):

MONEY cannot, in and of itself be “debt based.” Money IS value in exchange, not simply a demand for value. There has come to be a wide spread confusion over the difference between MONEY and currency. Whereas MONEY proper is THE value in a value for value exchange, currency is a medium of conveyance, not an intrinsic quantity offered in exchange.

In times past, American claims — Demand Notes or Bills FOR real MONEY read, “This Note Is “A” Legal Tender FOR Ten DOLLARS,” in either gold or silver coins. Notice, the Note or Bill is not the MONEY, but rather, a Demand to the banker for a redemption of the Note FOR MONEY, also called a “Promise To Pay” To The Bearer On Demand. What occurred was, Demand Notes as a matter of convenience, in time came to be exchanged instead of MONEY. Today’s Notes are not Notes, but rather a manipulated & fluctuating medium, or token units of exchange. Both MONEY and DOLLARS are measures, not values.

A currency cartel therefore, is the ULTIMATE CARTEL, with all significant political and economic decisions accruing to a few. To be sure, a currency cartel is the enemy of real MONEY, because whereas MONEY is a repository of labor and value accumulated from the past — an intrinsic value, an interest bearing currency, especially that of a privately controlled currency, is a demand upon the fruits of labor into the future. To see where we are headed, we must first know from whence we came, and especially as to how this affects words and perception.

Robert K said (December 21, 2014):

It’s encouraging to see Migchels gradually moving from an obsession about interest/usury toward the more critical issue (as far as personal freedom is concerned) of the control of “credit allocation”, which is seldom addressed by the simpletons who imagine that our monetary woes will somehow be cured merely by having bureaucrats in departments of finance control the issuance of interest-free money.

In all probability the results for the population of such an arrangement–i.e., absolute state dictatorship–would be worse than what our current corrupt financial masters are imposing. Proposals for “credit allocation” beneficial to all citizens have of course been at the core of the Social Credit proposals made by Clifford Hugh Douglas and his supporters for nearly a century.

Henry Makow received his Ph.D. in English Literature from the University of Toronto in 1982. He welcomes your comments at

Source Article from http://henrymakow.com/2014/12/matrix-made-of-money.html

Views: 0

RSS Feed

RSS Feed

December 22nd, 2014

December 22nd, 2014  FAKE NEWS for the Zionist agenda

FAKE NEWS for the Zionist agenda

Posted in

Posted in

Elm said (December 21, 2014):

MONEY cannot, in and of itself be “debt based.” Money IS value in exchange, not simply a demand for value. There has come to be a wide spread confusion over the difference between MONEY and currency. Whereas MONEY proper is THE value in a value for value exchange, currency is a medium of conveyance, not an intrinsic quantity offered in exchange.

In times past, American claims — Demand Notes or Bills FOR real MONEY read, “This Note Is “A” Legal Tender FOR Ten DOLLARS,” in either gold or silver coins. Notice, the Note or Bill is not the MONEY, but rather, a Demand to the banker for a redemption of the Note FOR MONEY, also called a “Promise To Pay” To The Bearer On Demand. What occurred was, Demand Notes as a matter of convenience, in time came to be exchanged instead of MONEY. Today’s Notes are not Notes, but rather a manipulated & fluctuating medium, or token units of exchange. Both MONEY and DOLLARS are measures, not values.

A currency cartel therefore, is the ULTIMATE CARTEL, with all significant political and economic decisions accruing to a few. To be sure, a currency cartel is the enemy of real MONEY, because whereas MONEY is a repository of labor and value accumulated from the past — an intrinsic value, an interest bearing currency, especially that of a privately controlled currency, is a demand upon the fruits of labor into the future. To see where we are headed, we must first know from whence we came, and especially as to how this affects words and perception.

Tony B replies:

Elm, in this case at least, is a sower of confusion, exactly what the bankers love. I doubt if it’s so intended, sometimes it’s hard to get the point across with money because of all the past deliberately sown confusion.

The main part of the problem with his rant is that he is correct that the U.S. government used to peg our money to metal and he thinks, because the government did it or that it’s in the constitution (really isn’t) then it must be correct. It’s not correct. It’s dead wrong and it greatly confuses the issue.