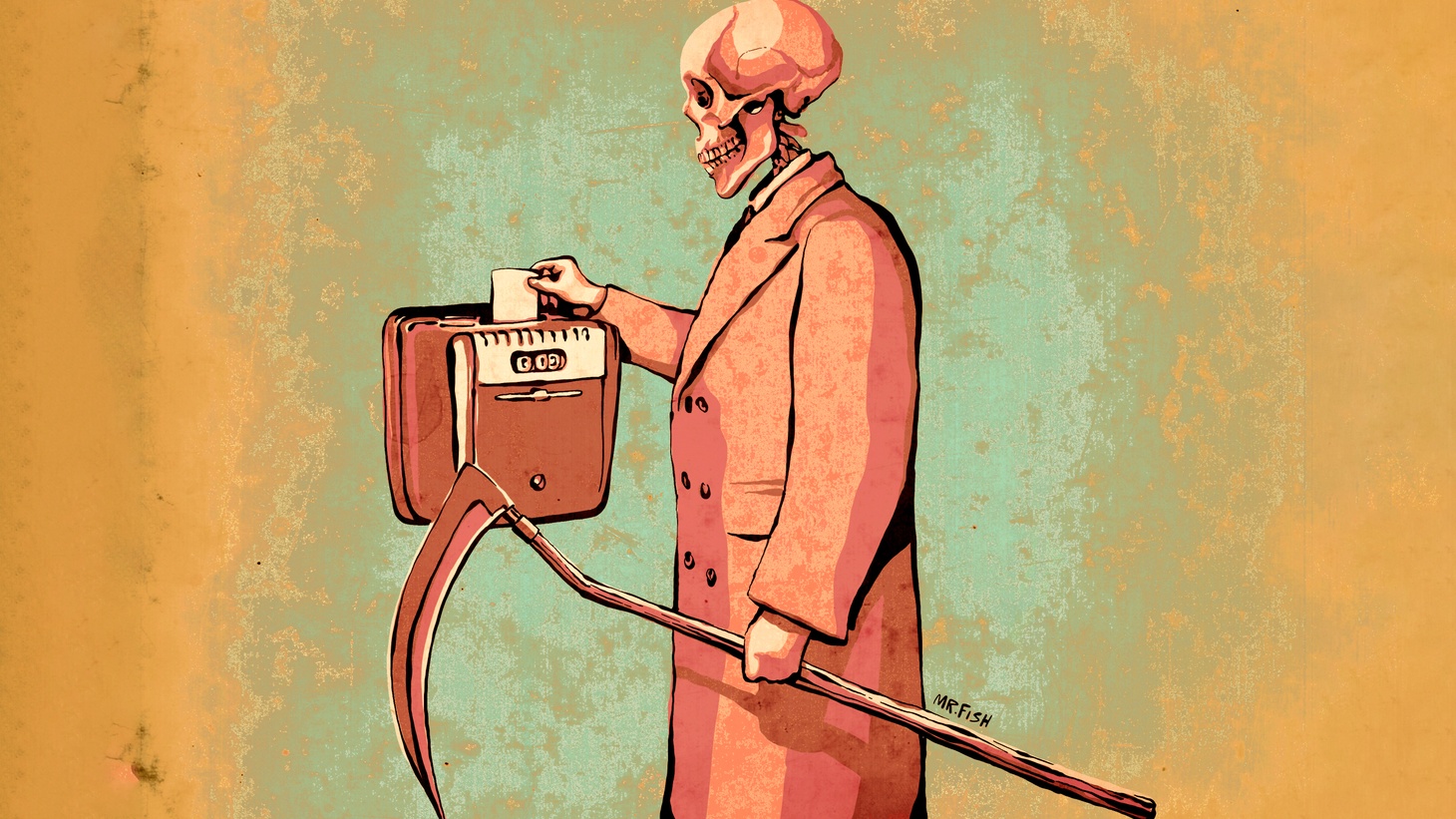

Above image: “Punch the Clock” by Mr. Fish.

A new book by Barbara Freese explores eight stories about the unfettered corporate greed that has corrupted modern society and led to an astounding loss of life.

Beginning with the slave trade and leading all the way up to the climate crisis, author Barbara Freese’s “Industrial Strength Denial” examines eight of private industries’ most egregious crimes against humanity. On this week’s installment of “Scheer Intelligence,” the author and former assistant attorney general of Minnesota joins Robert Scheer to discuss what the host calls “heinous behavior” on the part of the corporations involved in each case, and, most importantly, how the corporatization of the United States has allowed unfettered greed to cause irreversible harm and an astounding loss of life.

As Scheer explains, Freese’s detailed book refuses to fall into the trap of villainizing individual actors such as former Goldman Sachs CEO Lloyd Blankfein, or oil barons and tobacco company leaders, however depraved they may seem. Instead her book, published by the University of California Press, points to systemic corruption that has infected all aspects of American life and politics. Rather than “evil” CEOs, the Scheer Intelligence host says, “Industrial Strength Denial” is about the banality of evil, as Hannah Arendt defined it, that leads companies, for example, in the tobacco industry, to suppress information regarding deadly health outcomes in the name of obscene profit.

“Even though I know my book is in many respects kind of infuriating in terms of what it describes,” Freese tells Scheer, “I’m hoping actually to get folks to kind of step back a little bit, not look so much at the individuals, but to look at the context [to] recognize that these folks are responding to a society that rewards this kind of denial, and punishes honesty and social responsibility.”

Listen to the full conversation between Scheer and Freese as they discuss how time and again companies from Wall Street to Chevron have flouted human rights in order to squeeze inordinate amounts of money out of people and the planet.

Credits

Host: Robert Scheer

Producer: Joshua Scheer

Introduction: Natasha Hakimi Zapata

Transcription: Lucy Berbeo

Click to subscribe on: Apple / Spotify / Google Play

RS: Hi, this is Robert Scheer with another edition of Scheer Intelligence, where the intelligence comes from my guests. In this case, a very experienced lawyer, Barbara Freese, who worked for the attorney general of Minnesota, got involved in the cases against coal, cases involving distortion of the effect on our climate reality. And wrote a very important book, very well-received book, called Coal: A Human History, which was a New York Times notable book. Now, her newest book is called Industrial-Strength Denial: Eight Stories of Corporations Defending the Indefensible, from the Slave Trade to Climate Change. It’s a book published by the University of California Press. And it’s indispensable reading if you still, at this point in life, need a rejoinder or a counterpoint to the free-market, Ayn Rand, Alan Greenspan mythology that somehow the market will take care of it all. And it’s really a study with a strong emphasis on the psychology of going along with what you should not go along with. And it raises the basic two questions about corporate denial: causality and creating problems, and responsibility and fixing them. So could you just sort of describe the eight examples of corporate malfeasance, beginning with the whole slave trade in the colonial period?

BF: Sure, thank you. So yes, I plunged into the historical record to try to investigate this phenomenon of social, or rather of corporate denial, which I consider a social phenomenon. And the eight campaigns of denial that I focused on began with the slave trade in Britain defending itself against an abolition movement in the late 1700s. And then I kind of zoomed forward into the 20th and 21st centuries in the United States, with the radium industry, which was a short-lived industry that sold radium as a cure-all for human consumption; auto-safety debates that took place over whether the auto industry had any responsibility to try to make cars safer when they crashed; the debate over leaded gas, which happened both in the 1920s and then again picked up in the 1960s; the ozone-depletion dispute; the legendary denials around the tobacco issue; the pre-financial crisis work of Wall Street in the subprime mortgage industry; and then the climate denials of the fossil fuel industry. Those are the eight stories that I recount.

RS: And there’s a common theme in all this, which is a systemic denial of both, as I said before, causality and responsibility. They didn’t do the damage, they didn’t intend to, it would have been worse without them. And then even when there confronted with the disaster, there’s a denial they have a big responsibility, or a major responsibility, to set things right. So why don’t–and the process, and the strength of the book, is you try to get into the psychology of the corporation. Its incredible ability to rationalize, to not be held accountable, to just turn around and say oh, well, that’s life. And they get these huge salaries, bonuses, rewards. And they fail, actually, succeed by failing. It doesn’t matter, they’re still going to retire with considerable wealth.

BF: Hm. Well, that has certainly happened. We certainly saw that with the financial crisis.

RS: Yeah. But take us back to slavery. Because that–you know, everybody forgets that this most heinous of human economic activity–you know, the most disgraceful in human experience of enslaving people for commerce, was actually justified by very well-educated, sophisticated people. And just by coincidence, yesterday I read the majority decision in the Dred Scott decision, affirming slavery–and what they drew upon was English common law, the experience of civilized nations beginning with England, and then the U.S. under its Constitution. And embracing the idea that no person, no slave brought from Africa had any human rights or right to consideration as a human being. And the slave trade really was as American as apple pie. And we tend to make a disconnect with that history, which is your first chapter. So just bring us into the discussion, as you do in your book with that first chapter.

BF: Sure. I focused on the slave trade, actually, in Britain, or the campaign to defend the slave trade in Britain. Because Britain became the dominant force in the slave trade around the late 1700s, or in the 1700s. In the late 1700s, there was an abolition movement that was extremely effective, trying to make the, what should have been obvious point, that the slave trade is really quite brutal and very, very difficult on the slaves themselves. And that solicited from the industry this very organized and fairly modern campaign of denial, where they could deny on many different levels.

But one of the things that really, I think, unleashed them to be super creative in their denying was that the British public had no way to see what was really going on. They were not there in Africa, they were not there on the ships crossing the Atlantic, and they weren’t in the New World plantations, so they could be convinced of things that I think you would not have been able to convince an American audience of, or at least an audience in the South where they could see something about what was going on with slavery.

So for example, the slave lobby–and they did this in these lengthy pamphlets that they published–told the British public and the British policymakers that the Africans wanted to be purchased. That they sort of marketed themselves, that they enjoyed crossing the Atlantic on these sort of festive slave ships with singing and dancing, and that the plantations themselves were very comfortable, and they had terrific health care and wonderful diets, and life was actually easier for the slaves than it was for the poor people in Britain. That was actually a very common thing for them to do, to try to redirect sympathy and redirect attention to other people and other causes. But that was only one of many different kinds of denial that they used, including lots of techniques that would appear in later campaigns as well.

RS: Yeah, but it’s a mythology that was carried over to the New World.

BF: Right.

RS: And actually no country brought in as many slaves as the United States, the colonies and then the new government. And the fact of the matter is, this uncomfortable fact, is that the people who gave us this very much celebrated Constitution and system of governance and wrote the Declaration of Independence, bought into the very mythology that you’re describing. The fountainhead of American democracy was the South, and these Southern, slave-owning, racist founders. And they justified it in terms that were brought over from England. It was not part of the English empire experience that they were rebelling against. They were in fact embracing, and as it turned out, England for its own reasons during the colonial war and later in 1812, actually developed a more tolerant, or opportunistic view toward the slaves, than our founding fathers.

BF: Right. And of course, many of our founders were slave owners, and of course in this country it would take a war to put an end to it.

RS: Yeah, but I’m talking about the process of rationalizing, and it’s interesting that you begin your book, before you get to radium and nicotine and all the other things, to really show the capacity of so-called civilized people, when they’re in the pursuit of profit, to rationalize really abhorrent behavior. This is really a study of irresponsibility, beginning with slavery but extending right up to the climate change denial. Or right now, the pandemic denial.

BF: Yes–I think that’s a fair way to put it. And I would stress that it isn’t just about how lucrative this industry is, but about a lot of the social factors. This was a very respected industry; this was considered a totally legitimate industry, and there was all of this social support for doing it. And part of getting rid of this industry meant really trying to confront that social norm head-on, and persuade the British public and British policymakers that this was intolerably brutal.

RS: Right. And then, again, I’m trying to get the North American narrative here, because there’s a continuum in your book, going from slavery up through corporate irresponsibility to the present, or recent history, that gets at the reality that corporations act in a certain inherently amoral, irresponsible way even though they may be part of this great American democratic experience. They are inherently institutions of corruption of that experience.

BF: I think it’s very clear that they’re institutions that are designed to reward the profit motive–we could call it greed–and to suppress our natural instinct to not cause harm to others, our natural prosocial instincts. So you have, you know, among these incredibly powerful organizations, exactly the wrong set of incentives if you’re trying to create a society that is fair, and not taking crazy risks, and honest.

RS: Yeah, but–OK, but I want to–the book carries a very strong punch. These corporations engage in actually heinous behavior. That lives are put at risk, in every one of your examples–and you should briefly go through the different examples, whether it’s leading people to have cancer through cigarette smoking, or driving unsafe cars, or denying that you’re destroying the ozone layer with your hair sprays and your aerosol and so forth, or the banking meltdown. In each one of these chapters, they are a case study of absolutely horrible outcomes for society, for the environment, for the planet, that are justified by very reasonable-sounding people.

Let me take one example. So to cut to the chase here, you don’t deal with it at great length, but you have the case of selling cigarettes to women. Women were not thought to smoke–should not smoke cigarettes, and so forth. And here I want to bring in the enablers of corporate behavior. The public relations industry, the advertising, our major cultural institutions. The university. And then ultimately, the politicians. And what happened here–and you discuss it only for a couple of pages, but they’re very powerful. It involves Sigmund Freud’s nephew, Edward Bernays. And he is thought to be the founder of public relations as a profession. And in the 1920s, he got the idea that you could double the market for cigarette consumption if you could make it respectable for women to smoke. And he thought up a campaign to define women smoking cigarettes, that these are torches of freedom. And he got women to be in a Fifth Avenue parade, and suddenly light up, these debutantes to light up cigarettes, and make it fashionable. And then of course the entertainment industry, and Hollywood after, embraced that idea. And what we did is lead the half of the population that was not inclined to destroy their bodies with nicotine, would now be doing that. And again, it was a respectable activity. And it gave rise to even a profession, and the whole advertising community, the entertainment community–they all supported it. And the political community didn’t feel the need to regulate it. This was not treated the way, say, marijuana was. No–this was a good thing.

BF: Yeah, it was absolutely considered a legitimate industry. And actually, the overlap between tobacco and psychology is a particularly interesting one, and it goes on throughout the chapter that I’ve written on that. Because the industry dipped into whatever psychological insights them could find at the time; they did studies. What I find more appalling are some studies, for example, done in the 1970s where they had people trying to understand what motivates teenagers to smoke. And they did these surveys of, you know, high school kids basically, or 16-year-olds, I think. And talked to them about the pressure that made them want to smoke, and how they all assumed that they would someday be able to quite because they wouldn’t be addicted. And it was just so clear they were trying to use whatever psychological understandings they could of these, you know, vulnerable young people to get them addicted to something deadly, at a time when they knew it was very addictive and very deadly.

RS: So let’s talk–because your book has the strength of wedding psychology to greed. And we’re talking about not just snake-oil salesmen hustling the innocent rubes out of a tent. We’re talking about–you know, the movie Mad Men captured it, the series on television. We’re talking about very sharp, very well-compensated people, in the case of Bernays using the latest advances of psychology and so forth, to basically manipulate people. To coopt them, to create a culture that was not good for them. And that was true whether it was driving unsafe cars; it was true, as I say, about using aero sprays that would destroy the ozone; it was true about fossil fuels and destroying the climate, ultimately.

And what we’re really talking about is the profession of cooption that these corporations could tap into. And they could get very respectable people, including the moviemakers–including most of the journalists, because they didn’t really write very critically about this. When they did that Fifth Avenue parade with women lighting up these torches of freedom, the New York Times celebrated it. They thought, it’s just a great story, and women finding their freedom. There wasn’t much reporting about the danger of these activities. So we’re really talking about corporate cooption of the culture. Isn’t that really what your book’s about? That it’s not just that they make a lot of money; they have a lot of power. And with that power, they coopt everyone.

BF: They have tremendous power. One of the points I make in the book is that in many cases, you see a response that seems to be very much a simple human reflex based on what we know about psychology. For example, if somebody criticizes you, it is natural to get defensive, and it is natural to imagine that whoever is your critic might have some ulterior motive, and they can’t be telling the truth. What happens, I think, is that those reflexes then turn into a corporate strategy. So suddenly the corporation is trying to undermine the credibility of its critics, not just an individual’s reflect, but a corporate strategy. Then I think an industry forms to serve that corporate strategy–the public relations industry, advertisers, lawyers. And then it goes from reflex to strategy to industry, and finally into an ideology. And then you know it’s really taken deep roots in your culture, and it’s going to start having lots of political impacts, quite independent of the original denial.

In fact, if you think about this in the context of climate denial, you had the oil majors being, you know, raising all kinds of doubts about this for a very long time. Now they’re actually sort of accepting that this is a real problem, and we have to do something about it. But they’ve raised so many doubts, and they funded all of these groups that were so anti-regulatory, and those groups essentially took over the Republican Party and now control the White House and the Senate. So you know, ExxonMobil can say, yes, we support the goals of the Paris Accord–but at this point, it’s kind of too late, because the denial that they fostered for so long has taken such deep root that we just have these enormous barriers to overcome.

RS: Right. So, but even before the Citizens United decision of the court, and way before Donald Trump, the fact of the matter is–and you mentioned the Republican Party–the political process. Not just advertising and public relations. And much of university life gets corrupted by the power of money; after all, they can support all sorts of scholarship, including scholarship that justifies their activity. People like Ralph Nader, who is in your book, who dare challenge the automobile industry, are vilified by this industry. And they can buy off the best and the brightest; they can buy off very talented lawyers, advertising people, public relations, and so forth. And now, you mentioned, they can also buy or coopt a political party.

But in the case of one chapter in your book that I do want to discuss here–the banking meltdown, the Great Recession–it wasn’t the Republican Party that got bought off by these corporations. Because they were already there; they believed in the mantra of deregulation. Ronald Reagan tried to do it; he wasn’t very successful, because he had the savings and loan scandal, and so it was not the right time to deregulate banks and Wall Street. It actually remained for Bill Clinton as president, and for the Democratic Party, to make this opening to Wall Street and to do what’s described in your chapter on banking: the reversal of the New Deal, another great Democratic president, FDR. To reverse Glass-Steagall, to reverse the, breaking up the investment bank and the commercial bank. To allow all of these phony collateralized debt obligations and credit default swaps to flourish, and the packaging of subprime mortgages. All of that was basically enabled by an alliance between the Bill Clinton administration and the Republicans in the Congress, was it not?

BF: Yes, that’s absolutely the case. And I think it’s an illustration of an industry with way too much power, in part because we have a political system that is way too responsive to money, and that’s where the money is.

RS: Yeah. But, I mean, to–because sometimes it’s convenient to think that we know the enemy. [Laughs] The enemy is boorish, the enemy is–you know, is Donald Trump. He says offensive things, he’s overt and so forth. But actually, in your chapter on the housing meltdown and the scamming of Wall Street–which was massive, and so many people lost their homes; the economy wasn’t even fully recovered by the time this pandemic comes along, and we just were making up for lost time. The fact is, it was the more enlightened people, the more liberal people, the more Democratic people who went along with it. And I think, by the way, throughout all of the chapters in your book, whether it was Hollywood supporting smoking, you know, Hollywood’s advertising or the government not regulating, there’s responsibility on the part of both political parties. Certainly on the issue of slavery; the bedrock of slavery and segregation in this country was the Democratic, not the Republican party. So we’re talking about a process of corporate cooption that extends across the political spectrum. Is that not the case?

BF: That’s the case in many respects. But at the same time I wouldn’t want to minimize the distinction, in almost all of the campaigns that I mention, between what the Democratic Party was promoting at the time and the Republican. And certainly that’s the case right now, with climate change; I mean, there really are very huge differences. So–

RS: Well, that’s true.

BF: –enough corruption across the spectrum, but it isn’t equal on both sides, that’s for sure.

RS: Right, but in–you know, in the interest of providing balance here, when I read your chapter on the financial meltdown, the fact of the matter is that deregulation was signed off by a Democratic president, Bill Clinton.

BF: Right.

RS: And Lawrence Summers–who you don’t mention, but he’s still around, he’s still an advisor to Joe Biden; he was a big player in Barack Obama’s administration. And as secretary of the treasury, who had replaced Robert Rubin–who went off to work for Citibank, a bank made legal by this deregulation–Lawrence Summers is the one who in Congress, under the Clinton administration, said that, oh, we should deregulate Wall Street because they know what they’re doing. He attacked somebody named Brooksley Born, who was head of the Commodity Futures Trading Commission, who warned about all this, as did Warren Buffet. And yet in your book, as you point out, these people on Wall Street were pretending they knew what these packages were. You know, and yet it was under Clinton that we passed the Financial Services Modernization Act, the Commodity Futures Modernization Act in 2000 when he was a lame duck president, that made all of this stuff–and with AIG, and with Goldman Sachs–all of that was made legal by bipartisan legislation that Bill Clinton pushed for very energetically. And Lawrence Summers, the secretary of the treasury, was the main advocate. That’s just the record.

BF: Yeah, I would agree, it would have been nicer to have a much clearer perspective on this within the Democratic Party, and certainly as well within the Republican Party. Again, I guess I would just point out that with Dodd Frank, for example, you passed that with almost no Republican support at all. So even after the crisis, at least you had many Democrats in Congress trying to regulate this industry, whereas Republicans even after this crisis were still quite resistant to do so.

RS: Do you feel confident in that view?

BF: Confident that there’s a difference–

RS: Yeah. That there–because what you describe in your book is a general pattern of corruption that runs right through this society. That money talks. That these corporations have enormous power. They can shape the debate, they can basically get the best lawyers, the best PR people, they can get the Hollywood people, they can get the politicians to work for their interests. And in every one of your chapters, it’s bipartisan. It’s a process of corruption–I mean, I didn’t know that–were there Democrats that opposed aerosol spray? Were there really Democrats who wanted to make automobiles safer and have seat belts?

BF: Sure.

RS: It’s not in your book.

BF: Well, it isn’t mainly about the political parties, of course. It’s mainly about what the industries were doing. But you know, it was–it would have been mainly the Democrats who were concerned about these issues. And over time, in the past, Republicans would sort of move further and further toward their position, and finally you’d pass a bill which would be, you know, watered down but would at least improve the situation. One thing that struck me kind of amazingly was how often Republicans in the past would in fact ultimately sign on to the legislation that is sort of the culmination of the dispute. Of course we don’t see that anymore, and it strikes me as just a very vivid example of how far to the right the Republican Party has gone.

RS: So let me just push back a little bit on this. In your chapter, again, on the Great Recession, you single out Goldman Sachs. And you have Lloyd Blankfein as being one of the people–one of the points you make, from a moral point of view–wouldn’t you expect these people to be embarrassed, to be apologetic, to criticize themselves, right? You say that very clearly. And you even hold it out and say, hey, they didn’t do that. OK. But more to the point, when Barack Obama came in, he brought in these same–you were very critical of the Federal Reserve action, and Alan Greenspan and so forth, OK. But the fact is, Barack Obama took Timothy Geithner–who was the head of the New York Fed, who condoned all this, advocated all of this while Bush was president–he made him his secretary of the treasury. And then in the famous incident, even in the last election when Hillary Clinton was running, she gave those speeches to Goldman Sachs–and you vilify Goldman Sachs in your book. And in those speeches she said, I have to bring you with me to Washington–and she’s sitting right next to Lloyd Blankfein–she said because you people really know how to fix these problems. That was what happened. And just in the last presidential election. And so in your book you say this was a terrible development, but it was a–all I’m trying to push here, it was a two-party development. And in fact in the case of your chapter on the banking meltdown, it was the Democrats who took the lead on deregulating Wall Street.

BF: Well, I’m not sure they took the lead, but I know that they went along with it. I mean, I think that you had still very strong support in the Republican Party for that as well, and this was sort of a period where the Democrats were trying to be more moderate, more middle-of-the-road, and have a different perspective. And we ultimately–we, the nation, ultimately came to regret that, I think. I think you’re, you know, you’re right; I could have written a book that went more into the Obama administration, or Hillary Clinton’s perspective on Wall Street; that really wasn’t my topic.

RS: No, but what I think is consistent with your topic–and I do want to mention Industrial-Strength Denial, Barbara Freese, a very important book; I’m not taking anything away from it– Eight Stories of Corporations Defending the Indefensible, from the Slave Trade to Climate Change. And what I think is so powerful about this book is you don’t demonize the individual corporate leaders. You have, in fact, more modern ones who relate to the housing thing; Jamie Dimon from Chase Manhattan, you have a lot of them. I forget the fellow whose name that you had, who–what was his name? Oh, ah–goodness. Thomas [Midgley], who did both the leaded gasoline and the [chlorofluorocarbons] things–

BF: Oh, Midgley.

RS: Yeah, Midgley, sorry. And throughout your book, we’re introduced to these corporate players as people that you could have dinner with. They’re not, you know, foaming at the mouth. They’re just doing what they say is their job. You know, they have an ideology. And they can rationalize anything. They can rationalize, you know, spreading cancer. And they live in a culture–that’s all I’m trying to get at here–they live in a culture where rationalizing, evil behavior for profit, is the norm. And they are supported by an extensive cast of very smart, highly credentialed lawyers, public relations people, advertising people, university people, and ultimately politicians of every stripe–every stripe–who go along with them, and carry their message. Isn’t that really what’s so powerful about your book? I’m not trying to distort it. It just seems to me–

BF: Yeah, no, I think that’s–I appreciate that description of it. I think that’s exactly right. I mean, I do talk about a lot of these individuals, but my hope is not to get people to focus too much on the individual. Because what happens is we’ll tend to get angry, and we’ll think oh, these are evil people. And once you start putting on that particular moral judgment hat, where you say these people are evil, you tend to stop your inquiry. And what I’m hoping is–even though I know my book is in many respects kind of infuriating, in terms of what it describes–I’m hoping actually to get folks to kind of step back a little bit, not look so much at the individuals, but to look at the context, as you described it. And to recognize that these folks are responding to a society that rewards this kind of denial, and punishes honesty and social responsibility. And so that we can, hopefully, start talking about how do we change those aspects of our system, both within the corporate structure and economically, and the kind of soft, fuzzy ideas of social norms, and of course our laws.

RS: Yeah, you just put it much better than I did. And your book puts it very clearly. It’s “industrial-strength denial.” But what’s being denied is actually murder, sometimes; killing people; getting them sick; destroying the planet. And I keep getting back to this phrase in one podcast after another, from Hannah Arendt, the great critic of Nazism, as an extreme: the banality of evil.

BF: Mm-hmm.

RS: And your book reeks of–

BF: [Laughs]

RS: It really does, it’s the banality of evil.

BF: Yeah.

RS: Yes, it’s very well researched, it’s very thoughtful, it’s quite restrained in your judgment of–you know, you’re not condemning these people. But when you’re describing, say, Lloyd Blankfein, or the Goldman Sachs people, and all they’re talking about is the $65 million he made that year, while people lost their houses–that’s the banality of evil.

BF: Mm-hmm.

RS: I don’t care whether they vote Democratic or Republican. That’s the banality of evil. Isn’t that really what you’re saying when you talk about industrial-strength denial? You’re talking about the best minds in a society rationalizing horrible behavior.

BF: Exactly. And a system that encourages that.

RS: Well, there you have it. I want to thank you for writing the book. I want to recommend it. It’s called Industrial-Strength Denial. The author is a very knowledgeable attorney who’s taking cases against coal companies and others, and the issue of climate change, Barbara Freese. It’s published by the University of California [Press], and it’s Eight Stories of Corporations Defending the Indefensible, from the Slave Trade to Climate Change. That’s it for this edition of Scheer Intelligence. Our engineer at [the] KCRW NPR station is Christopher Ho. Natasha Hakimi Zapata writes the introduction. And Joshua Scheer is the overall producer of Scheer Intelligence. See you next week with another edition of Scheer Intelligence.

Related posts:

Views: 0

RSS Feed

RSS Feed

August 22nd, 2020

August 22nd, 2020  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: