In some ways, we sympathize with Neel Kashkari’s fake “concern” about the unprecedented wealth inequality that has emerged in the US in recent years and which has resulted in a slow, methodical and relentless destruction of the US middle class … or rather make that precedented because there was another time when the top 0.1% had amassed as much wealth and it was just before the Great Depression.

After all, who hasn’t seen charts such as these showing the tremendous divergence in income earned by America’s Top 1% at the expense of the middle and lower classes:

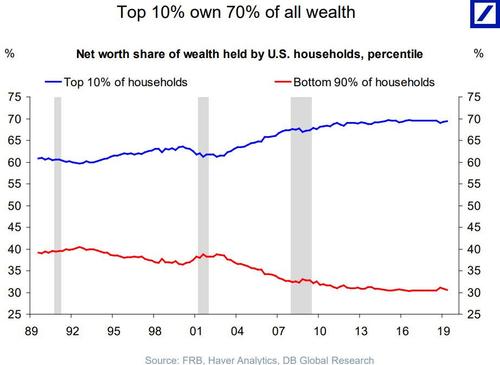

Or that the top 10% now own 70% of all the US wealth, the same as the middle and lower classes combined…

… up 10% from the 60% of wealth they controlled at the start of the century.

Yet we find Kashkari’s “jaw-dropping” virtue signalling proposal to grant the Fed wealth redistribution power not only laughable but absolutely terrifying: after all it was the Fed’s ZIRP and QE that was behind the greatest wealth redistribution in the past decade…

… a redistribution that started almost 50 years ago, when Nixon decided to end the Fed’s biggest nemesis – the US gold standard – launching an unprecedented increase in income growth for the “Top 1%”, even as the income of the “Bottom 90%” has remained unchanged ever since 1971.

For those confused, Rabobank’s Michael Every put it best: of course the Fed can redistribute wealth but “that redistribution has been from the poor and middle-class to the rich, not the other way round.“

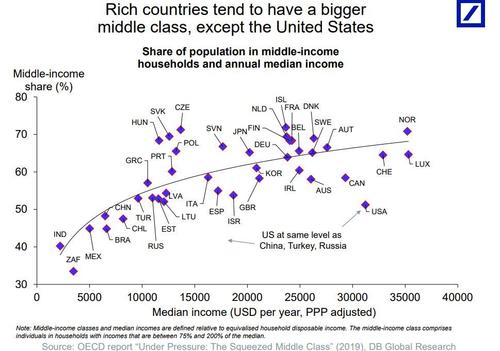

Unfortunately, as we showed back in November 2019, it may already be too late to fix the US: as the following stunning chart shows, the US is already effectively a banana republic if one defines such a nation as one which has a small but ultrapowerful and unaccountable kleptocracy which gets richer year after year by stealing from the rapidly shrinking middle class.

Here is the problem: while the US has one one of the highest median incomes in the entire world, with only three countries boasting a higher income, it is who gets to collect this money that is the major problem, because as the chart also shows, with just a 50% share of the population in middle-income households, the US is now in the same category as such “banana republics” as Turkey, China and, drumroll, Russia.

What is just as stunning: according to the OECD, more than half of the countries in question have a more vibrant middle class than the US.

Alas, since November 2019 it has only gotten worse… much worse because as a result of the unprecedented wealth redistribution unleashed by the covid pandemic, America’s has truly cemented its banana republic status as the wealth of the top 1% exploded as a direct result of the Fed pumping trillions into the stock market and levitating asset values, while the lower and middle classes stagnated.

Two weeks ago, when discussing the latest US record household net worth number, which hit an all time high of $142 trillion or up $31 trillion since Covid, we showed that it would be great if this wealth increase was spread evenly across most Americans, but unfortunately, most Americans have not benefited from recent gains in wealth.

Indeed, the latest data as of Q1 shows that the top 1% accounts for over $41.5 trillion of total household net worth, with the number rising to over $90 trillion for just the top 10%. Meanwhile, the bottom half of the US population has virtually no assets at all. On a percentage basis, just the Top 1% now own a record 32.1% share of total US net worth, or $45.6 trillion. In other words, the richest Americans have never owned a greater share of US household income than they do, largely thanks to the Fed. Meanwhile, the bottom 50% own just 2% of all net worth, or a paltry $2.8 trillion. They do own most of the debt though…

And the saddest chart of all: the wealth of the bottom 50% is virtually unchanged since 2006, while the net worth of the Top 1% has risen by 132% from $17.9 trillion to $41.5 trillion.

All of which brings us to the latest update from the Fed on Household Wealth distribution published on Friday and covering the second quarter of 2021, and which revealed yet another jawdropping fact about America’s full transformation into a banana republic.

According to the Fed data, which breaks down the distribution of wealth according to income quintile (or 20% bucket) with a special carve out for the top 1%, the middle 60% of US households by income (those in the 20% to 80% income range) – a measure economists use as a definition of the middle class – saw their combined assets drop from 26.7% to 26.6% of national wealth as of June, the lowest in Federal Reserve data, while for the first time the super rich had a bigger share, at 27%.

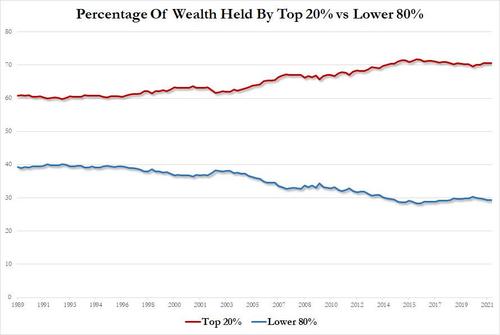

While especially true for the top 1%, it is all the rich that have benefited at the expense of the extinction of the US middle class – as the next chart shows, over the past 30 years, 10 percentage points of American wealth has shifted to the top 20% of earners, who now hold 70% of the total. The bottom 80% are left with less than 30%.

Some context: while “middle class” is a fluid concept, many economists use income to define the group. The 77.5 million families in the middle 60% make about $27,000 to $141,000 annually, based on Census Bureau data. As Bloomberg notes, their share in three main categories of assets – real estate, equities and private businesses – slumped in one generation. That made their lives more precarious, with fewer financial reserves to fall back on when they lose their jobs.

On the other end, the top 1% represents those 1.3 million households out of a total of almost 130 million, who roughly make more than $500,000 a year. The concentration of wealth in the hands of a fraction of the population is at the core of some of the country’s major political battles. It was also made possible entirely by the Fed, which as Stanley Druckenmiller said back in May echoing what we have said since our inception back in 2009, has been the single “greatest engine of wealth inequality” in history (to which we would also add the end of the gold standard under Nixon).

“If the economic system isn’t working for the clear majority of the population, it will eventually lose political support,” Nathan Sheets, newly appointed chief economist at Citigroup Inc., said by email. “This observation is motivating many of the economic reforms that the Biden Administration is putting forward.”

And while Joe Biden is seeking to “bolster” working- and middle-class families with a $3.5 trillion package before Congress that includes assistance with child care, education and health care paid for with tax increases on high-income individuals, what he will do is make the rich even richer as the Fed will have to monetize all those trillions in new debt, boosting risk asset prices even higher, and while the middle class spends any one-time fiscal stimulus merely to cover soaring costs of everyday items like rent and gas, it is the top 1% who will benefit the most again as they stock portfolios hit new all time highs.

It’s not just stocks that have benefited the super rich: housing has too. While a generation ago, the middle class held more than 44% of real estate assets in the country, it is now down to 38%. The pandemic generated a boom in housing values that has benefited most those who owned real estate in the first place. It also led to soaring rents this year, which hurt those who can’t afford a house. The self-feeding loop was yet another source of wealth transfer for the wealthier.

So the next time someone abuses the popular phrase “they hate us for our [fill in the blank]”, perhaps it’s time to counter that “they” may not “hate” us at all, but rather are making fun of what has quietly and slowly but surely become the world’s biggest banana republic?

And it has not Russia, nor China, nor any other foreign enemy to blame except one: the Federal Reserve Bank of the United States.

RSS Feed

RSS Feed

October 10th, 2021

October 10th, 2021  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: