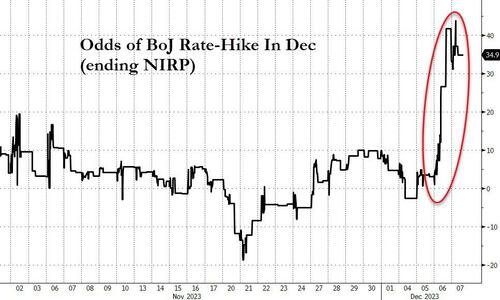

After a brutal drop in interest rates across the globe in November, driven by expectations of imminent rate cuts by heretofore hawkish central banks, markets have seen a sharp reversal in tone in the past 12 hours, with bond yields seeing a significant increase overnight and equities losing ground, despite a major bond rally taking place yesterday. The main catalyst for this have been comments from Bank of Japan officials, which have suddenly seen investors ramp up the chances that the BoJ could bring an end to their negative interest rate policy, with markets pricing in nearly 50% odds of a December hike.

Why the sudden change? Well, yesterday we saw Deputy Governor Himono discuss the impact of negative rates, pointing out that households could benefit from higher net interest income if rates were positive (which, of course, is a “brilliant” conclusion: if interest rates are positive one may actually earn interest instead of paying it, thank you BOJ). He also added that “there would be a sufficient possibility of achieving a positive outcome from the exit, since a wide range of households and firms would benefit from the virtuous cycle between wages and prices”. So some fairly positive remarks about what could happen in such a scenario.

Then this morning, we’ve BoJ Governor Ueda himself, who added to that speculation by saying that policy management would “become even more challenging from the year-end and heading into next year”.

In turn, bipolar investors who were certain the BOJ would do nothing until mid-2024 and the yen traded as low as 152 just a few weeks ago, are now pricing in a 37% chance that the BoJ are going to end their negative interest rate policy at the meeting on December 19, and at one point overnight that even got as high as 45%…

… which in turn sent the USDJPY tumbling a whopping 250 pips in its biggest one-day drop since January, sliding to 144.81, the lowest since September.

Japanese government bonds also saw a sharp selloff, with yields on 10yr JGBs up +11.5bps overnight, and that move got further support after a dreadful 30yr auction saw weak demand and the lowest bid-to-cover since 2015.

Moreover, the impact hasn’t just been confined to Japan, with yields on 10yr Treasuries up +6.8bps overnight to 4.17%, although as discussed yesterday, the Treasury rally was due for a substantial pullback even without the BOJ: “Both valuation and positioning would argue for exhaustion in the recent bond rally,” said Mohit Kumar at Jefferies International. “Given our view of only a mild recession and inflation still remaining sticky, we would argue that the market has run a bit ahead of itself.”

So is the market – again – getting ahead of itself? As usual, the answer is yes, and even though the Bank of Japan has a terrible timing track record, most sellside research expect the central bank to not move until well into 2024.

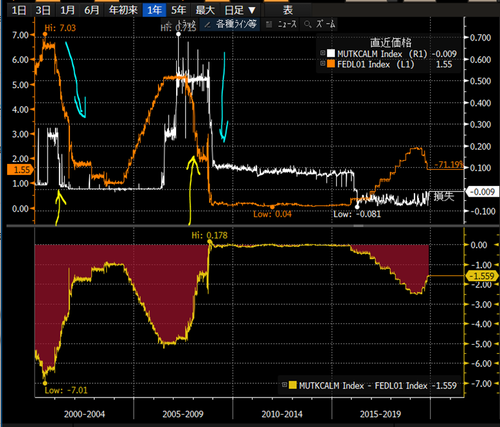

Case in point, UBS Research expect the BoJ to end its negative interest rate policy (NIRP) in April 2024. Simultaneously, the market is pricing the Fed’s first cut between March and May next year. Historically, this has happened before. BOJ’s rate hike in 2000 (25bp) and 2006 (50bp) were followed by FED’s cut as below.

That said, while a long-overdue rate hike by the BOJ should help Japan contain its runaway inflation, and should send prices tumbling into deflation post haste, hiking rates means a fresh round of mayhem and disarray in the JGB market, and an imminent reversal back into ZIRP and more QE.

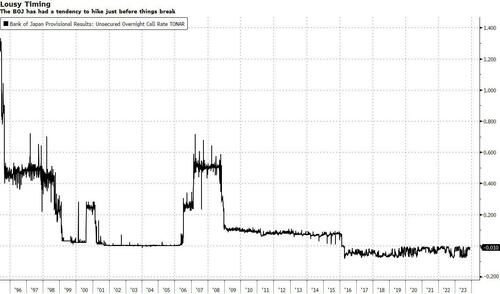

Indeed, as Bloomberg notes, one cannot help but wonder if the BOJ is about to repeat the mistakes of 2000 and 2006-07 by starting to hike after the Fed has finished, and usually just before something in the global economy breaks.

For those who may not recall, the BOJ launched ZIRP in the late 1990s after an extended period of rates at 0.50% failed to spur a recovery from the implosion of the 1980s twin bubble and the associated fallout in the banking system. Yet in August 2000, the BOJ put rates back up to 0.25% (the unwinding of the dotcom bubble looked pretty orderly and well-contained at that point). And whoops! Just a couple of weeks after the BOJ hike, the Nasdaq bubble burst, starting a swoon that didn’t really end for more than two years.

But wait, there’s more: a few years later, meanwhile, the country was enveloped in a wave of optimism courtesy of the dynamic leadership of former PM Junichiro Koizumi. The BOJ hiked in July 2006, and again in February 2007. A few days after that second hike, Chinese stocks dropped nearly 9% in a single day…still the largest daily decline of the century for that market. A few months later, a couple of Bear Stearns credit hedge funds imploded, ushering in the GFC.

“Obviously one shouldn’t posit a causal relationship there, because there isn’t one. It’s more a case of when the BOJ finally gets around to tightening, it seems that it’s late enough in the cycle that something goes seriously wrong elsewhere soon thereafter.”

Bottom line: while we don’t think a rate hike by the BOJ is imminent – and may never even happen, the central bank is best known for its jawboning not so much for its actions – should Ueda indeed proceed to hike rates, and thus start the countdown to the next crisis, it would tie in perfectly with our recent report that the “Sudden Spike In SOFR Hints At Mounting Reserve Shortage, Early Restart Of QE“, because there will be no better catalyst for the Fed to restart QE than having one of its central bank peers throw the world into a fresh round of chaos.

Loading…

This post was originally published on this site

The post BOJ Shocks With Hints Of Imminent Rate Hike, Traditionally A Signal Of Imminent Financial Crisis appeared first on Nemos News Network.

RSS Feed

RSS Feed

December 8th, 2023

December 8th, 2023  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: