SOCIAL SECURITY HAS A $2.6 TRILLION DOLLAR SURPLUS!

Bernie Sanders Speaks Well For Social Security So Why Did He Turncoat On Glass Steagall?

- The Contemptible Mr Bernie Sanders ~ ‘Get Rid Of America’s Competitive Private Insurance’

- Breaking 11/12/2012 => 20 States Deluge White House With Secession Petitions!

Rothschild Hides Behind Each Operative.

THE YEAR IS 1913

A)

In 1913 Rothschild Finance Lenin To Orchestrate Socialism In Russia And Depopulation.

“Medicine is the keystone of the arch of socialism.” – Vladimir Lenin 1, 2, 3 Flowchart

Rothschild funded Bolsheviks would go on in the course of history to slaughter 60 million Christians and Non-jews in Soviet controlled territory.

- True Cost Of Debt Ceiling Alone By ‘Too Big To Fail Bailout’ ~ From $700 Billion To $12.8 Trillion.

- Breaking => Banking Cabalist’s Global Warming Scheme Blown Out Of The Water: NASA Satellite Data.

B)

In 1917 Rothschild Uses Sun Yat Sen To Socialize China.

Did you know that Sun Yat Sen was born in China moved to Hawaii (where he received a COLB just like obama) in order to escape the death penalty and then return to China in 1917, to establish the centralization of the banking system to Rothschild London base? The Mao Tse Tung Takes The reins to depopulate. Anita Dunn resigned her position as White House Communications Director for Obama when video surfaced which exposed her as being in favor of the communist philosophy of Chinese dictator and mass murderer, Mao Tse Tung. Dunn admitted her communist inclinations in a speech to a group of high school students. Mao Zedong’s regime (1949-1975) killed 70,000,000.

The Latest Rothschild – Jacob

C)

In 1913 Rothschild’s Fed Reserve Takes Over United State‘s Currency.

Lenin is also on record as having stated,

“The establishment of a central bank is 90% of communizing a nation.”

- Rothschild Bank of London

- Warburg Bank of Hamburg

- Rothschild Bank of Berlin

- Lehman Brothers of New York

- Lazard Brothers of Paris

- Kuhn LoebBank of New York

- Israel Moses Seif Banks of Italy

- Goldman, Sachs of New York

- Warburg Bank of Amsterdam

- Chase Manhattan Bank of New York

- Now ask a question – Where is the Federal Government of the United States listed and how much does it get? I will answer it for you, it is not listed because the Federal Reserve is private and The United States receives nothing.

- Congressman Charles Lindbergh stated the following about the passing of the Federal Reserve Act on December 23, 1913

- “The Act establishes the most gigantic trust on earth. When the President signs this Bill, the invisible government of the monetary power will be legalized…….The greatest crime of the ages is perpetrated by this banking and currency bill.”

- It is important to note that the Federal Reserve is a private company, it is neither Federal nor does it have any Reserve. It is conservatively estimated that profits exceed $150 billion per year and the Federal Reserve has never once in its history published accounts.

- 1914: The Rothschilds have control of the three European news agencies, Wolff (est. 1849) in Germany, Reuters (est. 1851) in England, and Havas (est. 1835) in France.

- The Rothschilds use Wolff to manipulate the German people into a fervour for war. From now on the Rothschilds are rarely reported in the media, because they own the media.

- 1918: The Rothschilds order the execution by the Bolsheviks they control, of Tsar Nicholas II and his entire family in Russia. This is the Rothschilds revenge for Tsar Alexander II siding with President Abraham Lincoln in 1864.

- It is extremely important for them to slaughter the entire family including women and children in order to show the world, this is what happens if you ever attempt to cross the Rothschilds.

- The Wicked Witch Osama & Wizard Obama: Rothschild The Elephant In The Room!

- Yes, Hitler and Osama Bin Laden were reported to have died on the same day.

D)

In 1913 The Rothschilds set up the Anti Defamation League.

(ADL) in the United States designed to brand as, “anti-Semitic,” anyone who questions or challenges the Global Elite.

Do not confuse Abrahamic Jews With Teutonic Zionists aka; Rothschild Banking Cartel. This is how Rothschild tries to

hide behind The Jewish People. Rothschild is not a Jew, He Is German, and lives in Britain. He bought Israel As A Modus To

exorbitantly tax them in his money centralizing scheme, as India just kicked Rothschild out.

E)

In 1933 FDR Stops Rothschild’s Derivative Banking Scheme With Glass Steagall Act.

Needless to say, the 1933 Glass Steagall Act stopped the flow of money into Rothschild’s coffers.

It took about 7 years for WWII to begin.

F)

So In 1933 Rothschild Intalls Hitler For Centralizing The Banks And Depopulation.

War Is Money. GLOBALISTS CALL FOR ’BIG WAR’

“There are some people who seriously doubt that Johann Georg Hiedler was the father of Alois. Thyssen and Koehler, for example, claim that Chancellor Dollfuss had ordered the Austrian police to conduct a thorough investigation into the Hitler family.

As a result of this investigation a secret document was prepared that proved that Maria Anna Schicklgruber was living in Vienna at the time she conceived.

Hitler murdered 31,000,000 people.

At that time she was employed as a servant in the home of Baron Rothschild. As soon as the family discovered her pregnancy she was sent back to her home in Spital where Alois was born.

Alois Hitler, father of Adolf, was the illegitimate son of Maria Anna Schicklgruber and Baron Rothschild.

According to these sources, Adolf Hitler knew of the existence of this document and the incriminating evidence it contained. In order to obtain it he precipitated events in Austria and initiated the assassination of Dollfuss.

According to this story, he failed to obtain the document at that time since Dollfuss had secreted it and had told Schuschnigg of its whereabouts so that in the event of his death the independence of Austria would remain assured. Several stories of this general character are in circulation. (Langer, The Mind of Adolf Hitler, p.107).”

The super-rich families like the Rockefellers, Rothschilds and Roosevelts all intermarry and outsiders are not welcome. They believe that the U.S. should be an hereditary MONARCHY with their family members as kings and queens!!

- “Power kills: genocide and mass murder”

- Italy Calls France, United States, & Britain To Immediately Halt Libya War: Italy Blocks Use Of Their Airbases By NATO. Now Rothschild Puts The Screws To Italy!

“I place economy among the first and most important virtues, and public debt as the greatest of dangers. To preserve our independence, we must not let our rulers load us with perpetual debt.”

-Thomas Jefferson

Did you know Rothschild Banks has been stopped before and that some of our Presidents have been assassinated by this Bastard Banking Family?

G)

In 1999 Bill Clinton Repeals The Glass Steagall Act Allowing Rothschild Derivative Scheme Which Culminated In The Housing Bubble Catastrophe.

It took about 8 years for the bailout on fraudulent derivatives to begin.

What are Derivatives?

Derivatives are financial instruments that have no intrinsic value, but derive their value from something else. They hedge the risk of owning things that are subject to unexpected price fluctuations, e.g. foreign currencies, bushels of wheat, stocks and government bonds. There are two main types: futures, or contracts for future delivery at a specified price, and options that give one party the opportunity to buy from or sell to the other side at a prearranged price.

Derivatives and Speculation

The job of a derivatives trader is like that of a bookie once removed, taking bets on people making bets.

Keynes on Speculation

“Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick, not the faces which he himself finds the prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view.”

“It is not a case of choosing those which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree when we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practise the fourth, fifth and higher degrees.”

Keynes, John Maynard The general theory of employment, interest and money. London : Macmillan, St. Martin’s Press, 1936. page 156.

Derivatives and the Nobel Prize for Economics

Although futures markets have existed in some form since at least the 17th century, modern futures markets developed in the 1850′s with the opening of the Chicago Board of Trade. However, since the early 1970s financial futures markets dealing with currencies, shares and bonds have become much more important.

In 1971 the Bretton Woods system of fixed exchange rates broke down when the US suspended the convertibility of the dollar to gold. In a world of (mainly) floating exchange rates exporters and importers faced new risks. A couple of years later the Black-Scholes Model for determining the value of options was published. Its use caught on quickly and by the 1990s many financial institutions involved with derivatives were employing mathematicians and physicists to design ever more sophisticated financial instruments.

In 1997 the Royal Swedish Academy of Sciences awarded the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel (the Nobel Prize for economics) to Professor Robert C. Merton of Harvard University and Professor Myron S. Scholes of Stanford University, Stanford for their method of determining the value of derivatives.

Merton and Scholes, in collaboration with the late Fischer Black, developed a pioneering formula for the valuation of stock options. Their methodology has paved the way for economic valuations in many areas. It has also generated new types of financial instruments and facilitated more efficient risk management in society.

The $3.5 Billion Rescue of LTCM

Just a year after Merton and Scholes received the Nobel Prize for their work a hedge fund in which they were among the principal shareholders, Long Term Capital Management, had to be rescued at a cost of $3.5 billion dollars as it was feared that its collapse could have had a disastrous effect on financial institutions around the world.

The Paradox of Hedging Risks

Why should a hedge fund that included two Nobel prize-winners among its principal shareholders make staggering losses by trading in financial instruments designed to reduce risk? There was, presumably, nothing wrong with the techniques themselves, just the way in which they were used. It is sometimes argued that measures to improve the safety of car occupants, e.g. seat belts, increase risk by encouraging drivers to go faster than they would without them.

It is possible that the sophisticated models that apparently enable risk to be accurately quantified encourage risk taking by financiers who would otherwise err on the side of caution. However that does not explain other scandals that have involved derivatives, e.g. the collapse of Barings Bank or the illegal trades in Swedish stocks by a member of the Flaming Ferraris.

Derivatives Traders and Gamblers

Keynes may have been exaggerating when he wrote about investors who practise the fourth, fifth and higher degrees of speculation. However, futures and options are highly geared, or leveraged, transactions and therefore traders/investors are able to assume large positions – with similar sized risks – with very little up-front outlay.

By their very nature they encourage those higher degrees of speculation so that derivatives traders behave, as, like a bookie once removed. The potential rewards are such that a technique designed to reduce risk is all too often treated as a gambler’s tool.

Mispriced Derivatives Scandals

Derivatives are sometimes deliberately mispriced in order to conceal losses or to make profits by fraud.

Mispriced options were used by NatWest Capital Markets to conceal losses and the British Securities and Futures Authority concluded its disciplinary action against the firm and two of its employees, Kyriacos Papouis and Neil Dodgson, in May 2000.

In March 2001 a Japanese court fined Credit Suisse First Boston 40 million yen because a subsidiary had used complex derivatives transactions to conceal losses.

In Seeing Tomorrow: rewriting the rules of risk by Ron S. Dembo and Andrew Freeman, a case in which “clever but criminal staff got inside an options pricing model and used tiny changes to skim off a few million dollars of profits for themselves” is described on page 23. The culprits were not prosecuted because the bank feared that the revelation could wipe out hundreds of millions of dollars of its overall value.

Another possible case came to light in January 2006 when Anshul Rustagi, a London-based derivatives trader at Deutsche Bank was suspended after allegedly overstating profits on his own trading book by £30 million. He was subsequently dismissed.

Toxic Derivatives and the Credit Crunch

Credit default swaps were widely blamed for exacerbated the global financial crisis by hastening the demise of Lehman Brothers, AIG and other companies in 2008. By that year the derivatives market was worth over $516 trillion or about 10 times the value of the entire world’s output. This enormous ticking time bomb threatens to wreck international efforts to solve the world’s biggest financial crisis since the 1930s.

The most extraordinary thing is that the mainstream media has never attempted to compare the current economic environment to the one preceding the Great Depression. In essence, it is assumed outright that the Great Depression can never possibly happen again, ever, thus obviating the need for such a comparison.

I actually believe that the macroeconomic fundamentals today are much worse, so that we are in for a protracted period of economic depression – a depression much worse than the Great Depression, a depression that would likely be remembered in history as “The Second Great Depression” or The Greater Depression , as Doug Casey has called it so aptly. Here is why I believe that this is the case.

Duplicating Mistakes from the Great Depression

At its core, the environment of the 1990s, and the response of the Fed to the tech-telecom bust has created an economic environment that has encouraged the repetition of the very same mistakes that led to the Great Depression. Here is a concise summary of widely recognized mistakes of the 1920s, without going into the details, with obvious parallels in the current environment:

- Asset Bubbles – first in the stock market during the 1990s, then in real estate during the 2000s, pretty much mirroring the stock and real estate market bubbles of the 1920s.

- Securitization – although not in the very “ultra-modernistic” form and shape of the 2000s, with slicing and dicing of pools and tranches of seniority, it was widely recognized in the 1930s that securitization during the 20s drove the domino effect in the U.S. financial system during the Great Depression.

- Excessive Leverage – just like in 2008 the topic du jour is “deleveraging”, so the unwinding of leverage during the 1930s was the driver of forced liquidations and financial pain. Of course, it was very clear back then that the root of the problem was not deleveraging per se, but the excessive leverage that took place prior to the deleveraging process. “Investment Pools” were then instrumental in both the securitization and excessive leverage, just like the Hedge Funds of today.

- Corrupt Gatekeepers – we know well that the Enrons and Worldcoms were aided and abetted by the accounting firms – those same firms that were supposedly the Gatekeepers of the financial community, yet handsomely profited from the boom while neglecting their watchdog functions. In the current financial crisis, we also know that the rating agencies were also making hay during the boom. Very similar were the issues during the 1920s that led to the establishment of the SEC and other regulatory bodies to replace the malfunctioning “gatekeepers” at the time.

- Financial Engineering – we are led to believe that financial engineering is a rather recent phenomenon that flourished during the New Age Finance Era of the last 15 years, yet financial engineering was prevalent in the 1920s with very clear goals: (1) to evade restrictive regulations, (2) to increase leverage, and (3) to remove liabilities from the books, all too familiar to all of us today.

- Lagging Regulations – just like the regulatory environment lagged the events of the 1920s and regulations were introduced only after the Great Depression had obliterated the U.S. financial system, so we are yet to see new regulations addressing the causes of the current crisis. Understandably, regulations should have foreseen today’s financial problems and should have been introduced before the crisis.

- Market Ideology – back in the 1920s, just like in the last two decades, the market ideology of “laissez faire”, which Soros quite appropriately described as “Market Fundamentalism”, has swept the financial markets. Of course, the free market knows the best, but the reality is that the money market is not really free – when the Fed determines the cost of money (interest rates), and can fix this cost for as long as it wants, then all sorts of financial imbalances can be sustained without the discipline imposed by the market. This can lead to all sorts of problems that we actually have to face today.

- Non-Transparency – back in the 1930s, it was widely recognized that businesses and especially financial institutions lacked transparency, which allowed for the accumulation of significant imbalances and abuses. Today, financial markets and institutions have intentionally compromised transparency in a number of ingenious, or better disingenuous, accounting trickeries and financial gimmicks, like off-balance-sheet entities (SIVs), hard-to-understand derivatives, and opaque instruments with mind-boggling complexity. Today CEOs and Chief Risk Officers of major financial institutions cannot figure out their own risk exposures. Originally, lack of transparency was designed to fool the markets; ironically, modern-day financial executives have gotten to the point of fooling themselves.

Worse than the Great Depression

So, why Worse Than The Great Depression ? What makes me believe that the current depression will be worse than the Great Depression? I present six of the most important fundamentals that are “baked in the cake” and that suggest of a Greater Depression .

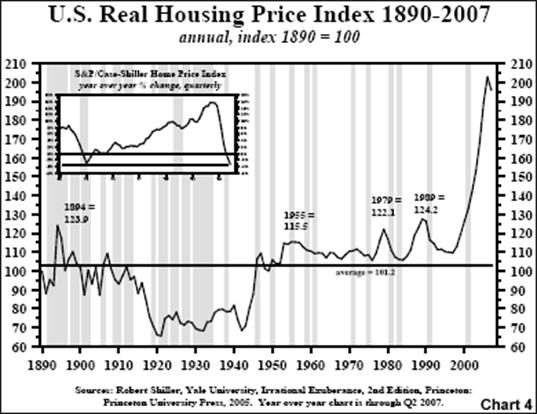

- Overvalued Real Estate. The real estate market has been driven by a number of innovations in real estate finance. Overvaluation in real estate implies overvaluation in real estate financial instruments; an implosion of real estate prices implies an implosion in those instruments. It is widely recognized by economists that the Case-Shiller Index is a good proxy for the prices of real estate. A widely-recognized chart from 1890 to 2007 tells the story. The chart makes it crystal clear that the current overvaluation of real estate in real terms grossly exceeds the one during the 1920s. The coming correction in real estate will be protracted and gut-wrenching, with an expected cumulative effect that is much worse than the Great Depression.

- Total U.S. Credit. Credit makes leverage: the more credit in the financial system, the more leveraged it is. Today’s total U.S. credit relative to GDP has surpassed significantly the levels preceding the Great Depression. Back then, the total amount of credit in the financial system almost reached an astonishing 250% of GDP. Using the same metric today, the debt level in the U.S. financial system surpassed 350% in 2008, while the level in 1982 was “only” 130%. As Charles Dumas from Lombard Street Research put it quite aptly, “we’ve had a 30-year leveraging up of America, ending in an unchecked orgy.”The chart below shows a dramatic buildup of debt (leverage) in the 1920s and a deleveraging from 1930 to 1945 (or 1952). Then it shows a consistent buildup of debt afterwards, with a dramatic rise since the 1990s, and surpassing in 2000 the previous peak in 1929. The chart shows the level of 299% at the end of 2005, but the level has already reached 350% by 2008.

- Of course, leveraging, as already indicated above, must necessarily be followed by deleveraging.The best way to think about leverage is to compare it with using drugs, while deleveraging is like detox. The problem is not that the detox is killing the patient who has abused drugs for years; what is really killing the patient is the drug abuse itself. However, one thing is clear – the patient must either go through a painful detox or die; the same applies for the financial system – it must either deleverage or implode.

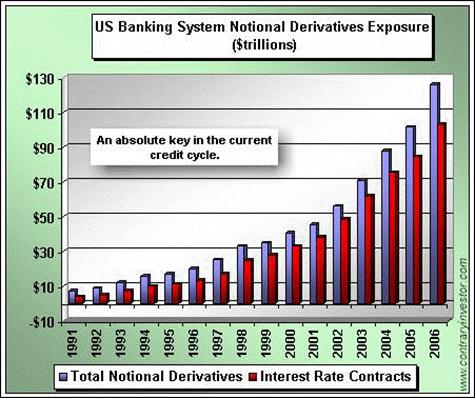

- Explosion of Derivatives. Derivatives have been likened by Warren Buffet to “financial weapons of mass destruction”. The notional amount of total derivatives, as well as “Value at Risk” (VaR), has skyrocketed in recent years with the potential to destabilize the financial system for decades. To put it more allegorically, derivatives hang like a sword of Damocles over the financial system.A comparison with the 1920s is difficult to make. mostly Derivatives back then were extensively used, although not widely understood. Given that I am not aware of any statistics of derivatives for the period of the 1920s, a meaningful comparison based on hard data is admittedly impossible.

- Nevertheless, I would venture to make an intelligent guess that the size of modern-day derivatives is hundreds or even thousands of times larger relative to the size of the economy in comparison to the 1920s. Some of the latest reports indicate that the total notional value of derivatives outstanding surpasses one quadrillion dollars. To put this into perspective, this amounts to almost 100 times the GDP of the U.S. economy.The chart below shows the explosion of derivatives in the U.S. banking system. You can see that in 1991 the notional value of the derivatives was about the size of the U.S. GDP. By 2006 the size has grown to about 10 times the GDP, vastly outgrowing the real economy.

The chart below shows an even more telling picture. It shows world GDP and world’s notional value of derivatives. Again, while there is no direct comparison with the 1920s, it is clear that the overall level of derivatives has skyrocketed during the last two decades and presents risks that were simply not present at the onset of the Great Depression. The unwinding of these derivatives could only be compared with a nuclear explosion in the financial system.

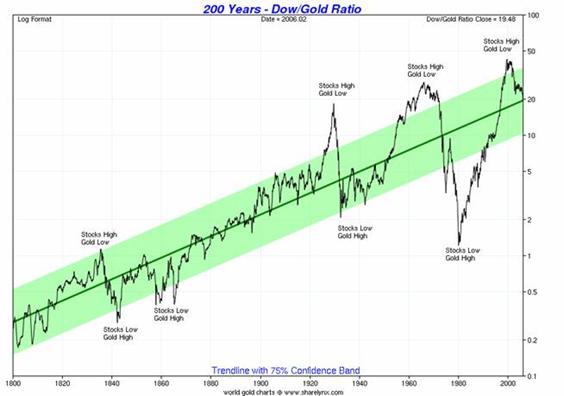

Dow-Gold Ratio. The Dow-Gold ratio represents the most important ratio between the relative prices of financial assets and real assets. The Dow component represents the valuation of financial assets; the gold component – of real assets.

When leverage in the financial system increases significantly, so does this ratio. A very high ratio is interpreted as an imbalance between financial and real assets – financial assets are grossly overvalued, while real assets are grossly undervalued.

It also implies that a correction eventually will be necessary – either through deflation, which implies deleveraging and a collapsing stock market, or through inflation, which implies stagnant stock market for many years and steadily rising prices of real assets, commodities, and gold, usually associated with stagnant economy and typically resulting in stagflation.

The first case—deflation—occurred during the 1930s, while the second case—stagflation—occurred during the 1970s.The graph below illustrates the above concepts. The very high Dow-Gold Ratio in 1929 was followed by the Great Depression, while the higher level in 1966 was followed by the stagflationary 70s.

It is evident from the chart the peak in 2000 surpassed the previous two peaks in 1929 and 1966, so this provides a reasonable expectation that the forthcoming return to “normalcy” will be more painful than the Great Depression, at least in terms of cumulative pain over the next 10-15 years.

Global Bubbles . It is impossible to make direct comparison with the 1920s, but today the global economy is rife with bubbles. Back then in the 1920s, the U.S. had its stock and real estate bubbles, while the European economies were struggling to rebuild from the devastations of WW1 that ended in 1919. I am personally not aware of any other bubbles during this period, although I welcome reader feedback on this topic.Today the picture is very different.

The U.S. economy had a stock market and real estate bubble that has surpassed its own during the 1920s. Colossal US current account deficits have fuelled extraordinary growth in global monetary reserves. As a result, Europe has real estate bubbles across the board, from the U.K. and Ireland, throughout the Mediterranean (Spain, France, Italy and Greece), to the entire Baltic region (Latvia, Lithuania, and Estonia) and the Balkans (Romaina and Bulgaria).

Even worse, many Asian countries (China, Korea, etc.) also have their own stock and property bubbles, only with the exception of Japan, which is still in the process of recovering from its own during the 1980s. Thus, during the 1920s only the U.S. suffered from gross financial imbalances, while today the imbalances have engulfed the whole world – both developed and developing.

It stands to reason that the unwinding of those global imbalances is likely to be more painful today than it was during the Great Depression due to both size and scope.

Collapsing Bretton Woods II. The global monetary system was on a quasi-gold standard during the 1920s. Back then dollars and pounds were convertible to gold, while all other currencies were convertible to dollars and pounds. An appropriate way to think about it is that of a precursor to the Bretton Woods from 1945-1971.

What is important to understand is that while the system was fiat in nature, gold imposed significant limitations to credit expansion and leveraging.Somewhat similar was the role of Bretton Woods that lasted from 1945 to 1971. The dollar was tied to gold, while all other fiat currencies were tied to the dollar. Just like the interwar period, gold imposed some limitations on credit and financial imbalances.We now live in what has been termed Bretton Woods II.

Essentially, this is a pure fiat dollar standard, where all currencies are convertible to dollars, either at fixed or floating exchange rates, while the dollar itself is convertible to “nothing”. Thus, the dollar has no limitations imposed to it by gold, so without the discipline of gold, the current global monetary system has accumulated significantly more imbalances than ever before in modern capitalism.

These imbalances show up in the international monetary system as unsustainable trade deficits (and surpluses), skyrocketing official dollar reserves in some European and many Asian central banks, and the proliferation of Sovereign Wealth Funds; more generally, these imbalances result in a myriad of bubbles, overleveraging, and other maladjustments already discussed above.

Today Bretton Woods II is in the process of disintegration. The world is slowly but steadily losing its confidence in the dollar as the world reserve currency. A flight from the dollar is in progress and the collapse of the global monetary system is imminent. As Bretton Woods II disintegrates and a new system replaces it, the process of readjustment will be necessarily more painful than the respective process during the Great Depression.

A caution on terminology is necessary here. While the literature over the last 10-20 years has widely recognized the term “Bretton Woods II”, in September-October of 2008 the term was widely used by the media to describe a proposed international summit with the goal of reconstructing a new international monetary system designed from scratch, just like “Bretton Woods”. Instantly dubbed by the media “Bretton Woods II”, this term could be potentially very confusing as it could mean very different things to different people. The interested reader should consult Wikipedia’s Bretton Woods II where both meanings are explained in detail.

Conclusion

Since August of 2007 we have witnessed the relentless escalation of the credit crisis: a steady constriction of credit markets, starting with subprime mortgage-backed securities, spreading to commercial paper, then to interbank credit, and then to CDOs, CLOs, jumbo mortgages, home equity lines of credit, LBOs and private equity markets, and then generally to the bond and securities markets.

While the media describes the problem as one of illiquidity and confidence, a more serious analysis indicates that boom-time credit has been employed unproductively and so losses must be incurred. In other words, scarce capital has been misallocated, poorly invested, and effectively wasted. No amount of monetary or fiscal policy can fix the errors of the past, just like no modern treatment can quickly restore to health a drug addict debilitated from a decade-long drug abuse.

Based on indicators like – (1) global real estate overvaluation, (2) indebtedness, (3) leverage, (4) outstanding derivatives, (5) global bubbles, and (6) the precariousness of the global monetary system, I would argue that the accumulated imbalances in the current period surpass significantly those preceding the Great Depression. I therefore conclude that the coming U.S. (and possibly) global depression will be of greater magnitude than the Great Depression of the 1930s. It likely suggests that we are entering a historic period that will likely be known as The Greater Depression .

Investor beware! Only gold can protect you from the ravages of another Depression!

By Dr Krassimir Petrov

Krassimir Petrov ( [email protected] ) has received his Ph. D. in economics from the Ohio State University and currently teaches Macroeconomics, International Finance, and Econometrics at the American University in Bulgaria. He is looking for a career in Dubai or the U. A. E.

American Soldiers Are Waking Up To Rothschild Banking Greed: U.S. Military Support For Taking America Back!

Related articles

- Bernie Sanders in a Fiery Speech: Do Not Cut Social Security, Medicare or Medicaid (alternet.org)

- Bernie Sanders Rips John Boehner for Calling for Cuts to Disabled Veterans’ Benefits (politicususa.com)

- Bernie Sanders- Summit on Social Security (5min.com)

- Bernie Sanders: ‘We Will Not Accept Cuts to Social Security, Medicare or Medicaid’ (alternet.org)

RSS Feed

RSS Feed

January 15th, 2013

January 15th, 2013  FAKE NEWS for the Zionist agenda

FAKE NEWS for the Zionist agenda

Posted in

Posted in