Most people probably don’t realise that emotion and human feeling comes into the stock market analysis too.

While it is largely a numbers game, and the industry and sector play a huge part – not to mention how the stock market itself is faring, two companies with similar numerical stats could differ greatly on the market. And that is because of who is buying and selling the stock.

Warren Buffett, arguably one of the most financially successful people, is often praised for how he was able to turn around stock options – something that his competitors wouldn’t have been able to do as easily with the same resources. And this is often deemed to be because of how he used behavioural finance.

Psychology also plays a part in the consumer experience. Humans are tied too strongly to their emotions to make fully logical consumer decisions – and savvy business leaders and marketers utilise this in order to make the most of the consumer in their commercial space.

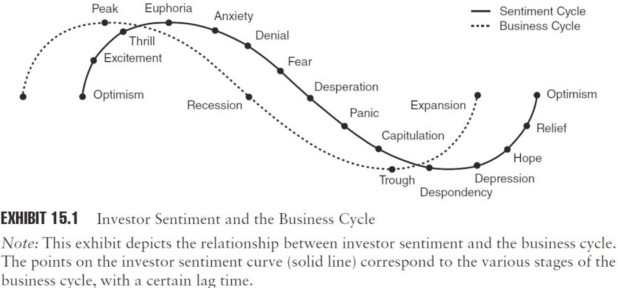

The behavioural finance curve, as outlined by Value Walk as a way of navigating the stock market index in order to match the investor with the cycle of the market, showcases the thought process involved in the buying and selling of stock. This can be utilized to reflect the consumer’s thought process as they shop – in order to illicit a greater spend per head. The original curve shows the sentiment of the investor to the market. As the market is doing well, the investor is feeling positive, as it begins to do decline, the investors’ feelings match this – with some time for lag.

If the business cycle is replaced by the lifespan of a product, the consumer can be convinced to buy the product. This is especially true of popular Christmas gifts (from Barbie to Elmo, to the Nintendo Wii). In the UK, the 2016 Christmas gift spend was £3.3billion. Initially, the consumer will feel euphoric at the prospect of purchasing the season’s must-have. The marketing campaign and pressure from their children will have combined to ensure the product was the most sought-after. But, as the sales rise, the toy becomes less easy to source. Matching the market’s recession comes the anxiety and fear as the consumer realises they might not be able to find the present for their child. This leads to panic and desperation and despondency. And then, as though it had been a marketing ploy all along, another batch of the gifts – limited edition, price increased – are released. While the stock market would begin expansion, the consumer will be filled with hope and relief. And the business would be highly profitable.

Of course, other factors are involved in purchase decisions, and the stock market cannot be predicted in the way that popular Christmas gifts can be. But, the cycles can be used in tandem to create a greater picture of the consumer and how they might operate compared to the business’s market. Consumers are driven by psychological needs, and the business uses these needs to ensure they are latching on to the mindset of the consumer in order to be better placed to market to them.

Source Article from http://www.hangthebankers.com/how-stock-market-behavioural-finance-can-be-used-on-consumers/

RSS Feed

RSS Feed

July 5th, 2017

July 5th, 2017  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: