“Confronting The Inevitable Chocolate Crisis” – Charting The Chaos In Cocoa Markets

Bloomberg Opinion columnist Javier Blas, who covers energy and commodities, opined in a piece on Monday about the “coming meltdown” in the global chocolate industry following decades of under-investment across West African nations.

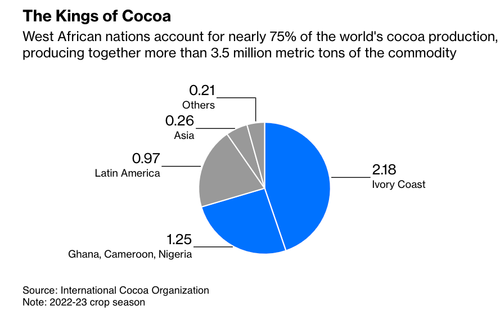

“Unlike most other agricultural commodities, cocoa hasn’t developed into a plantation business,” Blas said, adding poor farmers dominate cocoa farmers across West Africa, responsible for 75% of the world’s cocoa production. Meanwhile, he pointed out that investment only flowed into processing beans into chocolate – “not planting, growing and harvesting cocoa trees.”

Because of this, he warned: “We are all now confronting the inevitable chocolate crisis.”

The first chart Blas provided readers were cocoa futures in New York blasting into orbit. These prices now command $6,000 per ton, recently breaking the 1977 record.

“At the end of 2023, cocoa was one of only a four major commodities that still traded below their price peaks set in the 1970s, the previous commodity boom,” Blas said.

The commodities analysts said some forecasts suggest the cost of cocoa in New York could reach as high as $10,000 per ton.

What’s imminent is the West African cocoa shortage will be felt across supermarkets worldwide.

Just weeks ago, Michele Buck, chief executive officer of The Hershey Co., warned:

“We can’t talk about future pricing … given where cocoa prices are, we will be using every tool in our toolbox, including pricing, as a way to manage the business.”

The four main producing countries, accounting for 75% of the world’s cocoa production, are Ivory Coast, Ghana, Cameroon and Nigeria.

West Africa is the king of cocoa.

Blas presented a chart that illustrates the most significant cocoa bean deficit in modern history is currently underway. He said industry insiders are saying “the market is heading for a deficit of 300,000-to-500,000.”

And global cocoa inventories are collapsing.

“I’m unconvinced that climate change has anything to do with the current crisis,” Blas noted.

Separate from Blas, Bloomberg recently spoke with Paul Davis, the head of cocoa at major softs merchant Sucres et Denrees SA, who warned global cocoa markets will be “in a very tight balance” balance for another 18 months to three years.

Davis continued: “There is no cavalry that’s coming to the rescue.”

Sigh…

Tyler Durden

Mon, 02/19/2024 – 20:00 Source

RSS Feed

RSS Feed

February 20th, 2024

February 20th, 2024  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: