Pollsters got it right for once, in the first round of the French Presidential election.

However, the markets, and nearly knew everyone knew that the outcome would be Le Pen and Macron because they were clear frontrunners.

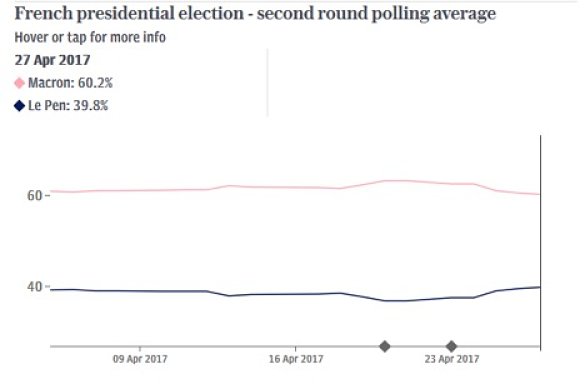

However, now some pollsters are placing just over a 60% of a Macron win, in the second and final round of the French Presidential election.

Now, we all know what happened in November 2016, when pollsters gave an extremely high probability that Clinton would win over Trump.

Here’s a look at what some pollsters are forecasting:

Source: Telegraph

After Macron led the first round of the French Presidential election, the markets went from risk-off trading back to a risk-on environment.

Now, risk-on trading caused some safe havens to drop significantly, these included gold and U.S. Treasury securities.

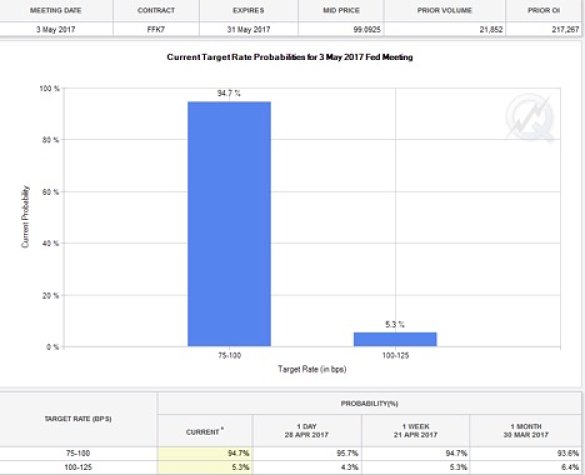

Now, before the second round of the French Presidential election, the Fed will meet on May 2-3, 2017.

The Fed typically does not surprise the markets, and here’s what traders are expecting:

Source: CME Group

“With the markets placing over a 90% probability on the Fed leaving rates unchanged, it should be unlikely that the Fed surprises the markets ahead of the French Presidential election. The second round of the French Presidential election should be interesting, but with highly uncertain events, such as the U.S. Presidential election and the final round of the French Presidential election, it’s a 50-50 probability”, according to trader Jason Bond.

The French Presidential election is just days away, but polls are still showing Macron with just under a 60% probability of winning. We have seen pollsters get it wrong before. For example, pollsters were shifting their probabilities ahead of the U.S. Presidential election, but they should have kept a more constant probability, around 50-50. Now, there is one problem with polls, and that’s sample bias.

Typically, those who are extremely passionate about the candidate they want to vote for will partake in the polls. However, this doesn’t take into account those who are indifferent, or simply are too busy to take part in polls.

Risk-Off Trading Could Come Back

Gold sold off once the first round of the French Presidential election results were released. Additionally, U.S. Treasury securities sold off a bit. This was primarily due to the risk-on environment, as traders saw the Macron lead more favorable to the markets. In turn, this caused a rise in global assets. However, risk-off sentiment could come back in a matter of days. “Typically, traders and investors do not want to be exposed heading into a highly uncertain event, and therefore, we might see gold prices being bid up ahead of the election on May 7, 2016,” one trader said.

What Now

The FOMC meeting will be this week, and the final round of the French Presidential election will be held next weekend. That in mind, the markets could see some volatility headed into these events, and there could be an increase in gold prices ahead of the election.

Source Article from http://www.hangthebankers.com/the-markets-shouldnt-place-such-a-high-probability-on-a-le-pen-win/

RSS Feed

RSS Feed

May 1st, 2017

May 1st, 2017  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: