Dollar Strength Poses Risk To China And Global Liquidity

Authored by Simon White, Bloomberg macro strategist,

A stronger dollar adding to yuan pressure is an ongoing risk to liquidity in China and the rest of the world.

The yuan fell versus the dollar overnight, with USDCNY nudging near 15-year highs. This is not something welcomed by Chinese policymakers, as evidenced by the gap between USDCNY and the official fixing at near-historical extremes.

China is mired in a slowdown that has caused capital outflow to increase.

Even though the country officially has a closed capital account, where there’s a will there’s a way, and when growth slows more capital tries to leave the country, with over-invoicing for exports and under-invoicing for imports among the common ruses used.

Given the capital account is nominally closed, we have to try to infer the level of capital outflow. One way is to look at the difference between official FX reserves, FX deposits at banks and the trade balance. In theory, the net proceeds from trade should end up either as FX reserves or deposits. Therefore, what doesn’t can be attributed to capital leakage.

Capital outflow has weakened this year, but is not as high as it was in 2022. This is one sign that, while things in China are not in good shape, they are perhaps not as bad as some of the more recent negative reports in the media have portrayed.

Capital outflow in a mercantile country like China, dependent on FX reserves for the solidity of its monetary system, has a geared, negative impact on domestic liquidity. Some currency weakness is desirable as it tempers this geared impact, but too much becomes counter-productive as it elicits more capital outflow.

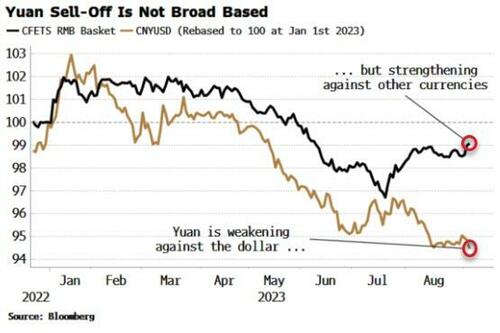

That is likely where we are in China and why policymakers there are pushing back on yuan weakness. But in another sign that the situation in China is not as desperate as some are projecting, the yuan’s weakness is not broad based, and in fact it has been strengthening versus the CFETS FX basket.

This is also a sign that China’s dependence on the dollar is reducing, as the yuan’s weakness against the USD is not creating a much worse domestic slowdown which would likely lead to broad-based weakness in the Chinese currency.

Nonetheless, the dollar’s strength still matters for China, and is a risk to its domestic liquidity. Which is therefore a risk to global liquidity given’s China’s pivotal role in driving global money growth over the last 20 years.

Tyler Durden

Wed, 09/06/2023 – 09:05 Source

RSS Feed

RSS Feed

September 6th, 2023

September 6th, 2023  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: