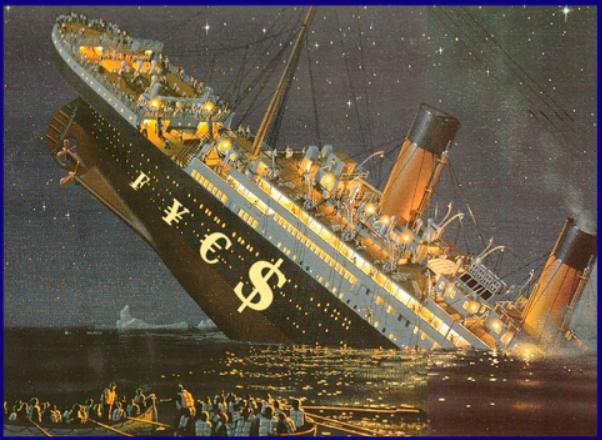

A grim Ministry of Finance (MOF) report circulating in the Kremlin today warns that Venezuela’s “nuclear option” crashing of its currency yesterday is a “clear signal” that the Western banking systems “house of cards”, erected in the aftermath of the 2007-2008 Global Economic Crisis, is in “total collapse” with the expected final outcome to be an “apocalyptic” crash of the US economy no later than April.

According to this MOF report, and what US financial experts described as “what lobbing a nuclear bomb into a currency war knife fight looks like”, Venezuela devalued its currency by an astounding 46% in the latest round of what is being described as the worst currency war our world has seen since the 1930’s, and which plunged the globe into total warfare.

Currency war, (World War C) also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a particular currency falls so too does the real price of exports from the country.

Imports become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets.

However, the price increase for imports can harm citizens’ purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.

Brazilian Finance Minister Guido Mantega, widely credited with coining the term “currency war”, further warned yesterday that the global situation could get even worse if Europe joins the fray, and which this MOF report warns the will have to do in the “very near future.”

Chris Richey, a top American financial analyst, further stated that as we have yet to enter a full-fledged war because the European Central Bank (ECB) and Bank of England (BOE) are not (yet) engaged in purposeful currency devaluation. Rather, since 2009, each has been pre-occupied with either saving their currency (the ECB) or saving their banking system (the BoE). The relative value of their respective currencies has not featured high on their list of priorities over the past four years.

Not so, however, Richey says, for the US Federal Reserve, the Swiss National Bank, the Bank of Japan, the Central Bank of Brazil, and the People’s Bank of China, all of whom have been very interested in the relative valuation of their currencies. And this is a list that matters because three of the top five global currencies are represented on that list and all of them have been engaged in competitive devaluations of their currency in order to promote their own exports.

This form of international contest, he continues, should strike those with a sense of history as similar to the trade and tariff wars of the Depression Era 1930′s: “beggaring thy neighbor” in order to extract one’s own country from economic straits. In the 1930′s, the “beggaring” took the form of either abandoning the gold standard, literally blocking the importation of foreign goods, or imposing tariffs so high that imports were effectively blocked.

This time around, he warns, there are no gold standards to abandon and international trade rules have become too ingrained, both economically and legally, for onerous tariffs or outright bans to be practical or legal. Thus, the only economic weapon left is that of currency devaluation.

Tensions were ratcheted up a couple notches with the recent election of Shinzo Abe as Japan’s Prime Minister this past December. As a candidate, Abe explicitly and repeatedly promised to double Japan’s inflation rate target from 1% to 2% via increased central government money printing, borrowing, and spending.

And while the Bank of Japan has pushed back against Mr. Abe’s proposals, we have still seen the Yen depreciate 25% against the Euro and 10% against the US Dollar since last July. In short, Japan is “all in” on making the Yen weaker and, thus, boosting Japan’s exporting companies.

Even worse, this MOF report says, with the US Federal Reserve admitting this past week that it has bought up more government debt than the US Treasury has issued (because no one else is buying it), and with China now accounting for nearly half of the world’s new money supply, the Baltic Dry Index (BDI) of international trade has totally collapsed to levels not seen since the start of the 2008 Economic Crisis.

Though the US propaganda media is failing to alert the American people to the shattering of their economy (exactly like they did prior to the 2008 collapse which cost these people trillions) the same cannot be said for the elite classes who continue to move billions out of their banks (the most since 11 September 2001) and whose corporate insiders are dumping huge numbers of shares in their own companies right now.

To the exact timeline of this coming collapse of the US economy, this report says, was “clearly shown” last week when the Swiss global banking giant UBS reported that an anonymous options trader had made an enormous $11.25 million bet that the VIX will explode between 20-25 April.

While the volatility index (aka the VIX, aka the “fear index”) is near historic lows, the Business Insider news service states about this trade that someone would have to be “VERY confident” in their outlook to risk $11 million on a directional position with the VIX at five year lows and the markets trying to break out to new highs.

To how the West is preparing for this coming economic collapse can be seen in France, where its President ordered the mobilisation of the secret services and police to carry out surveillance of workers fighting mass unemployment and factory closures, and in the United States (recently named by Human Rights Watch as the “ prison capital of the world”) whose Department of Homeland Security (DHS) this past week added tens-of-millions of more rounds to an arsenal said to equip it to wage a “30-year war” against the American people.

Most interesting to note of these events are them all occurring at a time when Eastern astrologers are warning that the “black water snake” (Year of the Snake) that emerges to replace The Year of the Dragon on 10 February — the first day of the Lunar New Year — could be a venomous one that brings disaster.

Previous Snake years have been marked by the 11 September 11 2001 terror strikes that killed nearly 3,000 people, the crushing of the 1989 Tiananmen pro-democracy protests and the Japanese attack on Pearl Harbor in 1941. The 1929 stock market plunge that heralded the Great Depression also occurred in a snake year.

To if these Western peoples will awaken to the dire tragedy that lies before them and protect themselves it is not in our knowing. What is known, however, and exactly like the year preceding the 2007-2008 collapse, those, like us, giving warnings are sure to be shunned and ridiculed while these people are robbed by their elite masters of what little remains of their wealth, freedom and dignity.

Did you like this information? Then please consider making a donation or subscribing to our Newsletter.

Source Article from http://feedproxy.google.com/~r/TheEuropeanUnionTimes/~3/BBLqpu-1gnY/

Views: 0

RSS Feed

RSS Feed

February 9th, 2013

February 9th, 2013  FAKE NEWS for the Zionist agenda

FAKE NEWS for the Zionist agenda  Posted in

Posted in