By Russ Winter

The mucky mucks at the Federal Reserve just released some very revealing minutes from 2012. For some inexplicable reason these came out very late. At present, minutes are released three weeks after meetings. The timing however is remarkable, as it reveals the sentiments of the new Fed Chairman Jerome Powell about tightening and drawing down the Fed’s massive portfolio. And there is an added surprise.

Powell: “When it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position.”

The key admission is that the Fed is also involved in some type of manipulation and intervention in suppressing volatility. In the stock market this is commonly referred to as VIX. So look at what’s happened to VIX since Powell’s remark. Wow, Pow(ell) is all we can say. There have been several upward spikes, but it is now at half century lows. So the aforementioned VIX unwind is still ahead.

Then yesterday as the VIX and markets continued to snooze, Moody’s came out with a negative credit assessment of the US tax bill. Whodathunk. The US’s AAA credit rating has to rank as one of the biggest farces out there.

Powell goes on to freely admit, six years ago, that interference in the VIX and buying a massive portfolio balance sheet has conjured an artificial undeserved “confidence”. “Dynamic response” is Fed head gobbledygook for investors having their heads handed to them.

Powell: “My third concern — and others have touched on it as well — is the problems of exiting from a near $4 trillion balance sheet. We’ve got a set of principles from June 2011 and have done some work since then, but it just seems to me that we seem to be way too confident that exit can be managed smoothly. Markets can be much more dynamic than we appear to think.

When you turn and say to the market, “I’ve got $1.2 trillion of these things,” it’s not just $20 billion a month — it’s the sight of the whole thing coming. And I think there is a pretty good chance that you could have quite a dynamic response in the market.“

It was long, long overdue, but the Fed balance sheet is being reduced NOW. It is a $20 bn run rate in the 1Q, 2018, increasing to $30 bn in the Q2 and so on, as shown on the chart below. Additionally inflation indicators the Fed follows are running increasingly hot. Powell as chairman will only continue the process, if not expedite it.

There are also signs that the Bank of Japan is done buying as well. These clowns are the biggest financial greater fool wild men in the world. If you think the ECB’s holdings of Steinhoff was stinking dead fish, wait until the losses in the Old Maid Cards the BoJ holds are revealed. The ECB purchases of rotting fish is reduced to 30 billion euros ($35 billion) from 60 billion euros, starting in January.

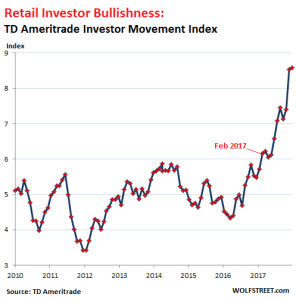

The market “hook” is that the lugenpresse is consistently referring to Jerome Powell as “Trump’s pick”. This is doth protest too loudly conditioning for Aunt Millie and Joe Sixpack and their “financial advisors” that Powell is an extension of the Trump administration. And the Trumpenstein rally has sucked Millie and Joe into the market – hook, line and sinker.

What is this skating on thin ice operation really all about? Trump has taken credit for the insane VIX manipulated stock market rally that has dominated since his election. But, this will only add to the fake drama and Kabuki theater to unfold. Trump, and by extension all the faux conservatives that support him, are the foils to take the blame when the ‘everything’ bubble vaporizes the economy and Aunt Millie’s net worth. Then Trump will go, but the parasite guild vampires and vultures he brought in will still be on hand.

This article originally appeared on The New Nationalist and was republished here with permission.

Source Article from http://www.renegadetribune.com/new-fed-reserve-head-powell-offers-serious-clues/

Related posts:

Views: 0

RSS Feed

RSS Feed

January 12th, 2018

January 12th, 2018  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: